Home / Business and Economy / Yen Rebounds as Japan & US Signal Intervention

Yen Rebounds as Japan & US Signal Intervention

26 Jan

Summary

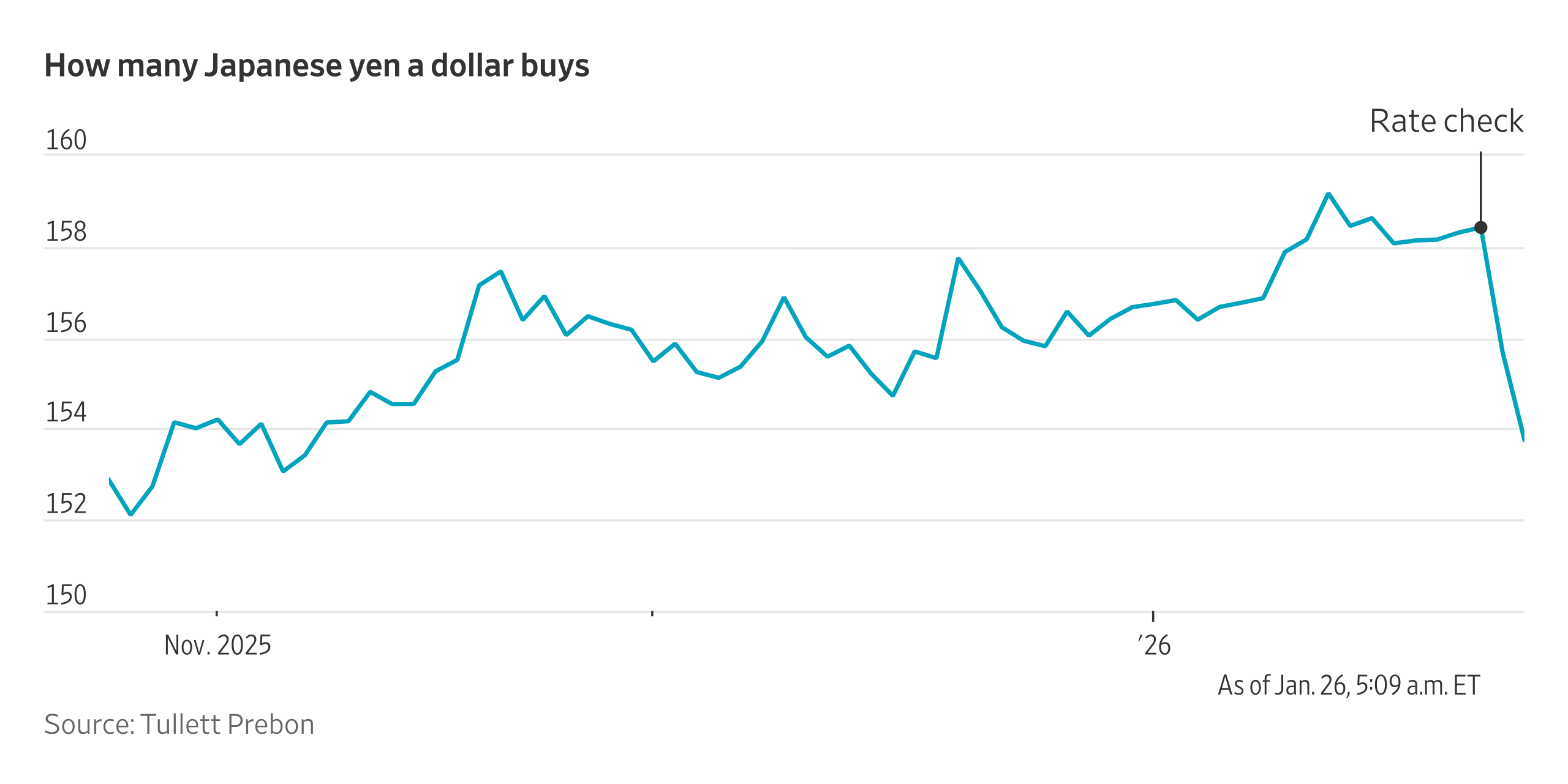

- Yen staged a rebound after US and Japanese officials signaled potential intervention.

- Japanese stocks and bond yields declined following the yen's recovery.

- Authorities contacted trading partners for rate checks, a precursor to intervention.

The Japanese yen has staged a significant rebound, recovering from a recent slide after both U.S. and Japanese authorities signaled their willingness to intervene in currency markets. This move extended into Monday, bolstering the currency's value.

The Federal Reserve Bank of New York, acting on the Treasury Department's directive, initiated rate checks with potential trading counterparties on Friday. Such inquiries often precede direct intervention in currency markets, a signal that appears to have been heeded by the market.

In response to the yen's strengthening, Japanese stocks and bond yields experienced a downturn. The Nikkei 225 index fell by 1.8%, notably affecting exporters in the automotive and electronics sectors.