Home / Business and Economy / Wells Fargo Stock Soars: From Scandal to All-Time High

Wells Fargo Stock Soars: From Scandal to All-Time High

14 Dec

Summary

- Wells Fargo stock reached an all-time high, trading near $90.

- CEO Charlie Scharf implemented reforms, cutting costs and boosting capital-light businesses.

- Regulatory capital requirements decreased, freeing up billions in excess capital.

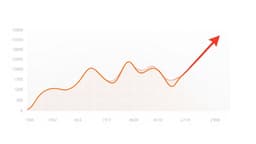

Seven years after facing a major scandal and a Federal Reserve asset cap, Wells Fargo has achieved a remarkable comeback. The bank's stock now trades at an all-time high, below $90 per share, with regulatory sanctions lifted. CEO Charlie Scharf, appointed in 2019, has been instrumental in this turnaround, addressing regulatory issues and implementing a new infrastructure. He also divested non-core assets, reduced expenses, and expanded capital-light operations like investment banking and credit card lending.

This strategic overhaul has led to improved financial performance, with Wells Fargo recently hitting its return target of a 15% return on tangible common equity (ROTCE). Management aims to further enhance returns to 17%-18% ROTCE, aligning with industry leaders. This will be achieved through revenue growth, efficiency gains, simplifying home lending, and optimizing capital allocation.