Home / Business and Economy / Goldman Sachs Sees 17% Upside in Viking Stock

Goldman Sachs Sees 17% Upside in Viking Stock

9 Dec, 2025

Summary

- Goldman Sachs upgraded Viking stock to buy with a $78 price target.

- Viking's affluent, US-based, 55+ demographic is projected to grow.

- The cruise line benefits from strong brand loyalty and no Caribbean exposure.

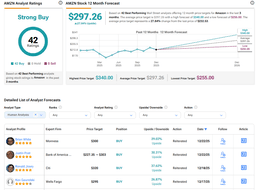

Goldman Sachs has upgraded Viking stock to 'buy,' with analyst Lizzie Dove raising the 12-month price target to $78, signaling a potential 17% upside. The bank's optimism stems from Viking's unique market position, characterized by its exposure to affluent U.S. travelers aged 55 and over, a demographic projected for substantial growth through 2054.

Dove emphasized that Viking's clearly identifiable brand has fostered exceptional customer loyalty, with its repeat guest percentage rising significantly since 2015. Furthermore, the company's strategic absence of Caribbean exposure shields it from broader industry uncertainties. Viking's expansion into higher-priced regions, like the Nile, and its strong financial footing, including a substantial cash reserve, also bolster its appeal.

The analyst anticipates decreasing cost growth for Viking, contrary to consensus expectations. Goldman Sachs also noted Viking's strong balance sheet and potential for future buyback programs, which could unlock material value for the stock. Viking shares experienced a modest increase following the upgrade.