Home / Business and Economy / Verizon Raises $10B in Bonds to Fund Frontier Acquisition

Verizon Raises $10B in Bonds to Fund Frontier Acquisition

10 Nov

Summary

- Verizon to raise $10B in corporate bonds to fund $20B Frontier deal

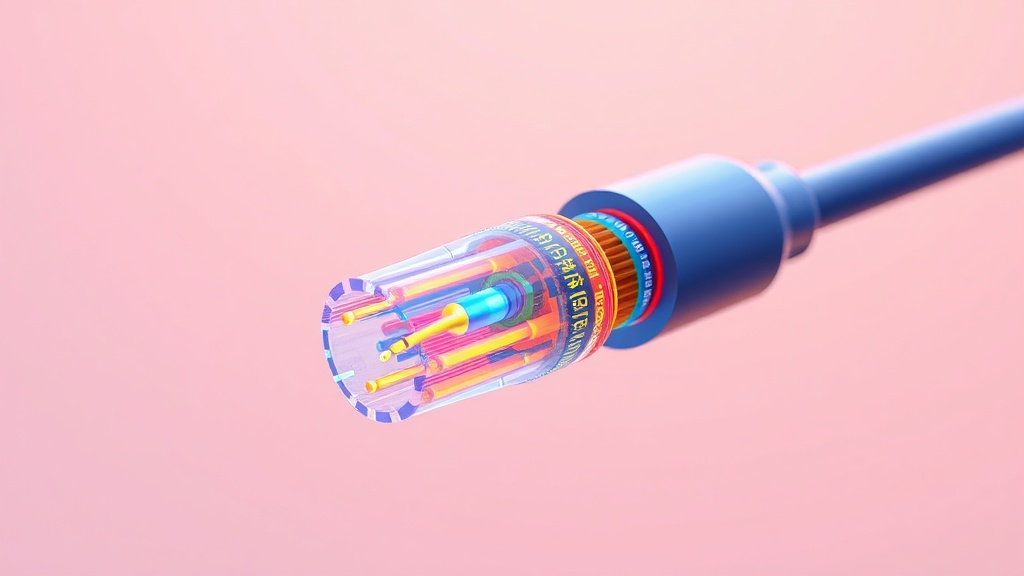

- Frontier is a fiber-optic internet provider Verizon is acquiring

- Verizon agreed to buy Frontier last year, absorbing $10B in Frontier debt

On November 10, 2025, Verizon Communications announced plans to raise approximately $10 billion in the corporate bond market to finance its $20 billion acquisition of Frontier Communications. The wireless carrier had agreed to purchase Frontier, a fiber-optic internet provider, last year, also absorbing $10 billion in Frontier's existing debt.

Verizon filed for a five-part bond sale earlier in the day, though the company did not disclose the exact size of the offering. According to the report, the initial price discussions for the longest portion of the deal, a 40-year bond, are about 1.6 percentage points above Treasuries.

The Verizon-Frontier deal is expected to close in early 2026, after receiving regulatory approval in May 2025 upon Verizon's agreement to end its diversity programs. The acquisition is part of Verizon's strategy to expand its fiber-optic internet footprint and compete more effectively in the broadband market.

The news follows Meta Platforms' announcement of a $30 billion bond sale last month, as enterprises rush to fund costly artificial intelligence expansion plans. Cloud infrastructure and software maker Oracle is also reportedly looking to raise $15 billion in bond sales.