Home / Business and Economy / Emerging Markets Fund Soars: 20% Up, Dividend Hero Status

Emerging Markets Fund Soars: 20% Up, Dividend Hero Status

14 Dec

Summary

- Share price increased over 20% with growing dividends.

- Fund managers visited South Asia, including China and South Korea.

- Investments focus on utilities and data centers, unlike rivals.

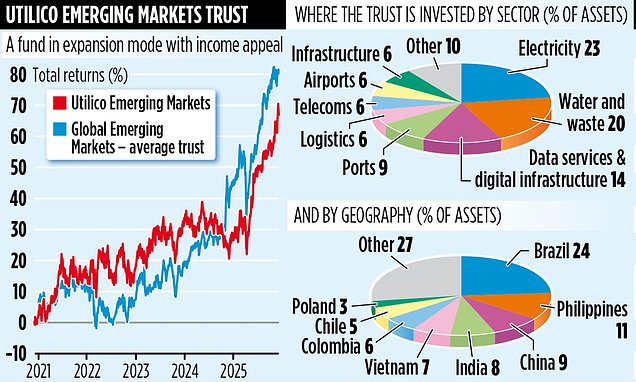

The Utilico Emerging Markets fund has delivered strong performance for its shareholders over the past year, marked by a share price increase exceeding 20% and a steady rise in dividend payouts. This success has led to its inclusion in the FTSE250 Index and designation as an 'early stage dividend hero' for achieving a decade of consecutive annual dividend growth, a feat unmatched by other emerging market funds. The management team remains actively engaged in seeking new investment opportunities, recently completing a two-week trip to South Asia.

During their recent expedition to China, Hong Kong, Malaysia, Philippines, and South Korea, joint managers Charles Jillings and Jacqueline Broers, along with senior analyst Mark Lebbell, witnessed advancements like driverless vehicles and flying taxis. This trip resulted in a new, 'small' investment in Chinese data center operator GDS, a company they believe is poised for growth due to the global demand for data centers fueled by artificial intelligence. Future travel plans include a trip to Central and South America in February.

The £476 million fund, holding 70 investments, distinguishes itself by concentrating on utility companies like energy and telecommunications providers, with approximately 80% of its portfolio invested in dividend-paying firms. This contrasts with rival funds that typically favor IT, financial, and consumer-oriented companies. Key holdings like the Philippines-based International Container Terminal Services exemplify the fund's strategy, showcasing consistent volume and revenue growth despite global trade uncertainties.