Home / Business and Economy / US Jobs Market: Is the 'Gloom' Overdone?

US Jobs Market: Is the 'Gloom' Overdone?

1 Dec

Summary

- Investors fear an economic split, with AI investment soaring while ordinary Americans struggle.

- Job creation and overall economic growth are diverging, an unusual trend.

- The Federal Reserve has recently cut interest rates twice as a precaution.

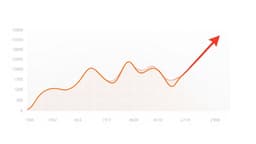

Fear grips leaders, investors, and policymakers regarding America's job market, with discussions of a "K-shaped" economy becoming common. This suggests a divergence where market growth, fueled by AI investments, thrives while average Americans face hardship. This separation between job creation and overall economic expansion is a notable departure from historical trends.

In response to these worrying signs, the Federal Reserve has enacted interest rate cuts at its two most recent meetings. Fed Chair Jerome Powell characterizes these moves as a prudent measure for 'risk management' against a possible deeper economic contraction. There is also advocacy from within the central bank for more aggressive rate reductions to bolster a softening jobs market.

However, a closer examination suggests that much of the prevailing pessimism may be exaggerated. While concerns are valid, the narrative of an impending jobs-pocalypse might be overstated. The divergence in economic indicators warrants attention but does not necessarily confirm the most dire predictions.