Home / Business and Economy / UK Borrowing Costs Shrink vs. US & Eurozone

UK Borrowing Costs Shrink vs. US & Eurozone

10 Dec

Summary

- UK government borrowing costs have recently decreased relative to the US and eurozone.

- A reduced borrowing premium could save the Treasury as much as £7 billion annually.

- Market doubts over inflation and fiscal plan adherence may explain past UK yield premiums.

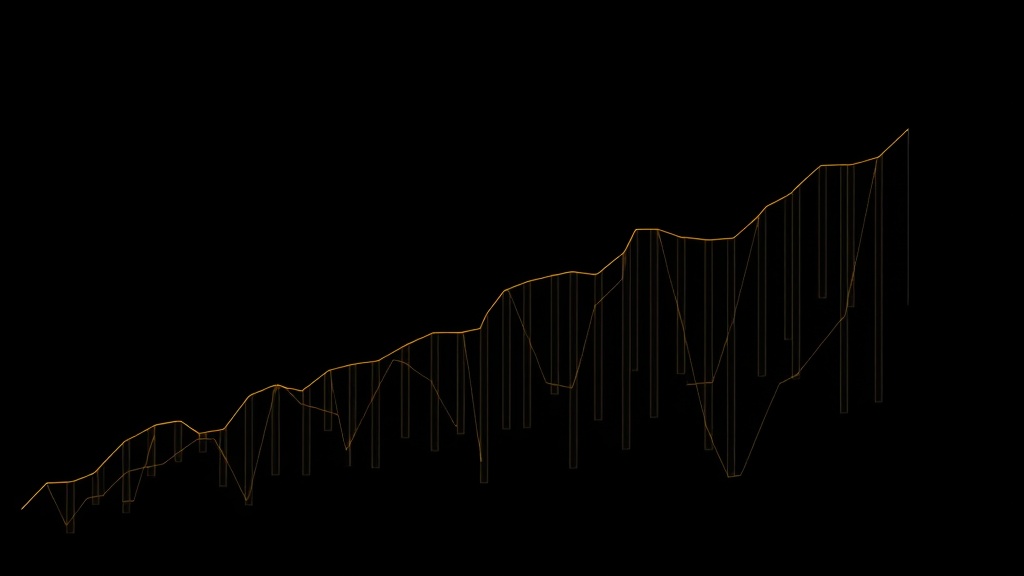

The cost of UK government borrowing has shown signs of decreasing relative to the United States and eurozone nations, offering a potential reprieve for the Treasury. While a premium on borrowing costs persists, recent improvements suggest a shift in market sentiment, possibly influenced by the government's renewed commitment to fiscal plans. This reduction in the yield premium could translate into substantial annual savings for the Treasury.

Factors contributing to the UK's previous higher borrowing costs included market doubts regarding long-term inflation and adherence to fiscal policies. However, recent statements and actions by the Chancellor, emphasizing fiscal discipline and rebuilding headroom, appear to be positively impacting market perception. This turnaround, though tentative, offers a more optimistic outlook for managing national debt interest.