Home / Business and Economy / Temple Bar Investment Trust Surges 158% in 2 Years, Managers Remain Optimistic

Temple Bar Investment Trust Surges 158% in 2 Years, Managers Remain Optimistic

16 Nov

Summary

- Temple Bar investment trust delivers 158% returns since 2020

- Managers find undervalued UK stocks, including M&S and NatWest

- Trust's value investing approach seen as protection against AI bubble

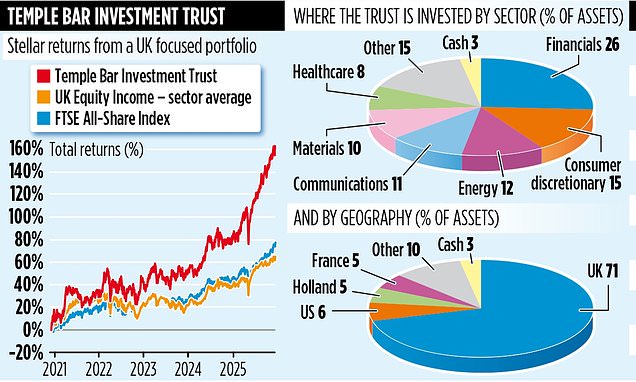

In the past two years, shareholders in the Temple Bar investment trust have seen the value of their holdings surge by an impressive 158%. This far outpaces the 77% gain in the FTSE All-Share Index and the 61% average for its UK equity income peer group over the same period.

The trust's success is largely attributed to the value investing approach of its managers, Ian Lance and Nick Purves of global investment house Redwheel. They have identified chronically undervalued UK companies and held them as their true worth has been recognized by the market. For example, they bought shares in Marks & Spencer for under £1 and NatWest at levels not seen since the 2008 financial crisis, and both stocks have since jumped by 193% and 292% respectively.