Home / Business and Economy / Bullish Strategist Predicts 18% S&P 500 Rally

Bullish Strategist Predicts 18% S&P 500 Rally

8 Dec, 2025

Summary

- An analyst forecasts an 18% S&P 500 increase by end-2026.

- Robust economic growth and monetary easing fuel the optimistic outlook.

- Cyclical sectors like tech and financials are favored over defensive stocks.

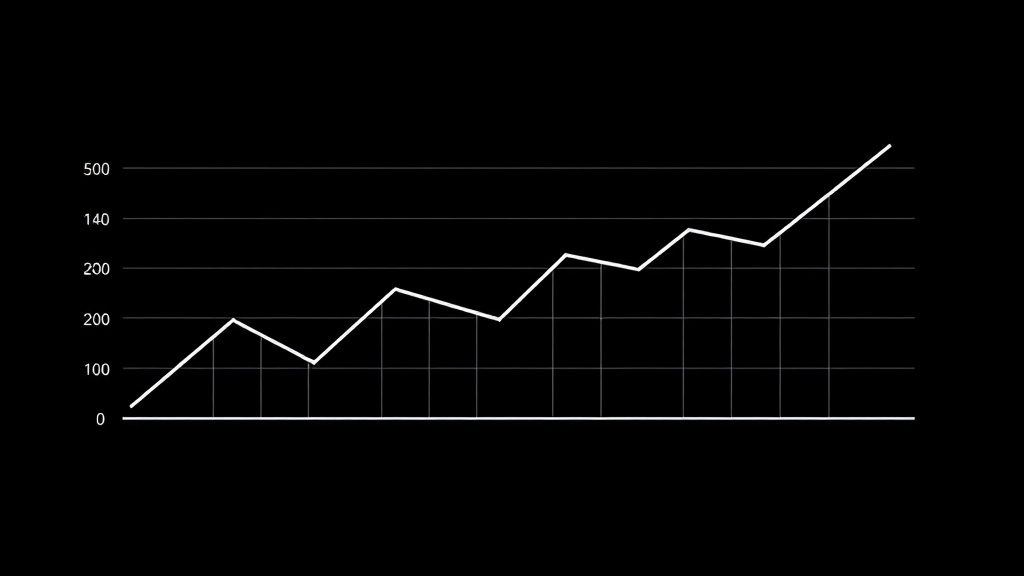

A leading strategist predicts a significant rally for US stocks, projecting the S&P 500 to climb 18% by the close of 2026. This optimistic forecast, placing the benchmark index around 8,100 points, is underpinned by expectations of robust economic expansion and a pivot towards more accommodative monetary policy.

This sentiment is shared by many in the financial industry, with several major institutions also forecasting double-digit gains for the market in the upcoming year. Money managers surveyed across major global regions are also preparing for a "risk-on" environment, indicating broad confidence in continued market strength.

The favored investment strategy emphasizes economy-linked cyclical sectors, such as information technology, communications services, industrials, financials, and consumer discretionary, over traditionally safer, defensive stocks. This approach aligns with the expectation that corporate earnings will remain strong, supporting further market appreciation.