Home / Business and Economy / Soybean Slump: China Deals Fade, Brazil Floods Market

Soybean Slump: China Deals Fade, Brazil Floods Market

15 Jan

Summary

- Soybean futures reached 16-month highs near $12 in November 2025.

- China pledged to purchase approximately 12 million metric tons of U.S. soybeans.

- A large Brazilian crop is currently causing concerns about global supply.

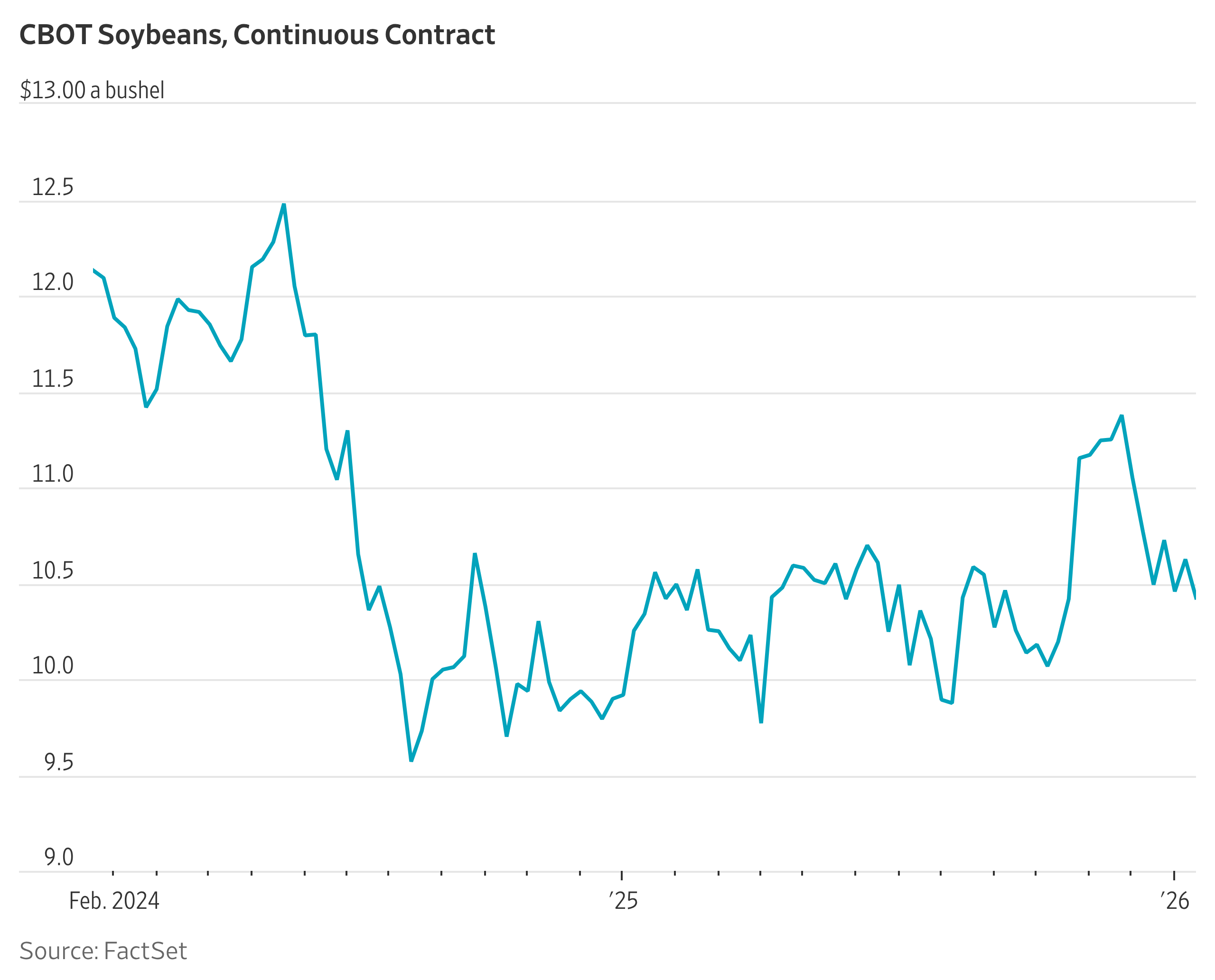

Soybean futures on the Chicago Board of Trade saw a notable increase in the latter half of 2025, reaching 16-month highs of nearly $12 per bushel in November. This surge was primarily driven by an announcement from China indicating plans to purchase approximately 12 million metric tons of U.S. soybean exports. The uptick provided a glimmer of economic hope for farmers, with soybean futures outperforming those of corn and wheat.

However, the positive trend proved short-lived. As of mid-January 2026, the most-active soybean contract had settled at $10.43 a bushel, marking a 10% decrease from the November high. This downturn is largely attributed to concerns over an exceptionally large crop harvested in Brazil. The anticipated increase in global supply is fueling worries about depressed prices for soybeans worldwide.