Home / Business and Economy / Cyber Insurance: SMBs' Shield Against Digital Threats

Cyber Insurance: SMBs' Shield Against Digital Threats

25 Nov

Summary

- Small businesses are frequent targets of cyberattacks due to weaker defenses.

- Cyber insurance costs can be significantly less than incident impact.

- Insurers act as proactive partners, identifying vulnerabilities before incidents.

Small businesses, defined as those with 100 to 1,000 employees and up to $50 million in annual revenue, are prime targets for cybercriminals due to often-weaker defenses. Cyber insurance has evolved into a strategic necessity, offering more than just financial recourse.

These policies provide a financial safety net against incidents like data breaches and ransomware, with premiums and deductibles frequently undershooting the potential impact of a single event. Beyond payouts, insurers act as proactive partners, assessing a business's security posture during underwriting and identifying vulnerabilities before they can be exploited.

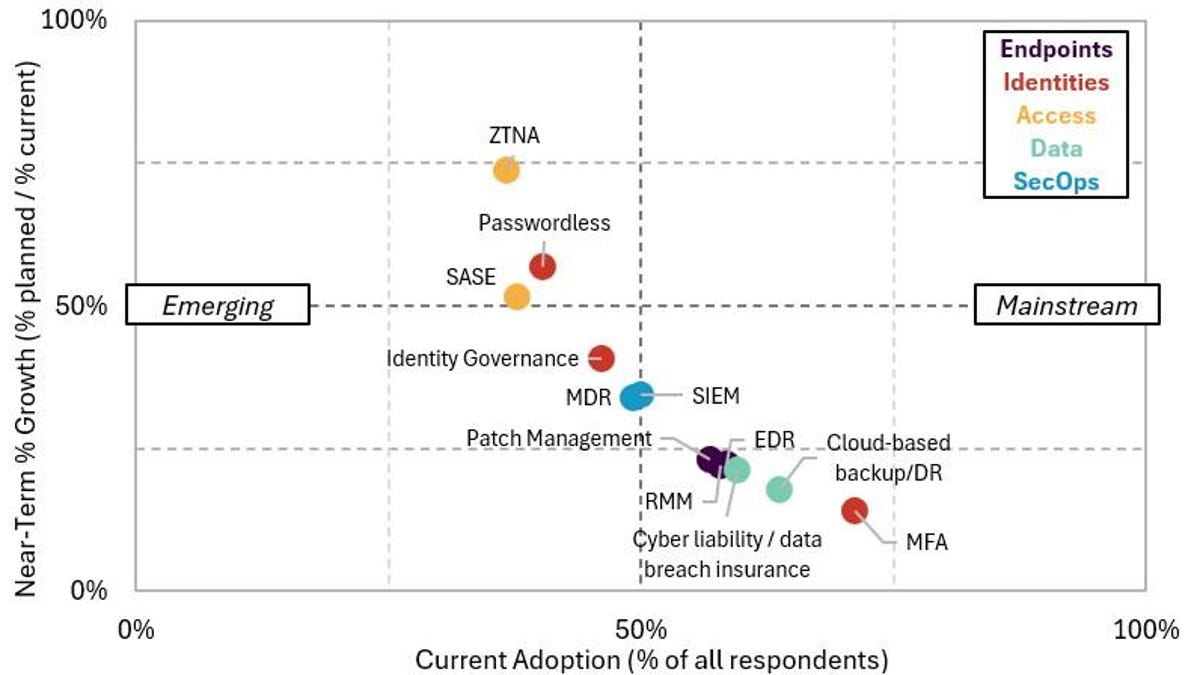

Meeting the baseline security requirements for cyber insurance, such as multi-factor authentication and endpoint detection, strengthens defenses. This proactive approach, combined with potential expert response teams and resources included in coverage, helps small businesses mitigate risks and enhance their overall resilience against the growing threat of cyberattacks.