Home / Business and Economy / Silver ETFs Plunge 20% Amid Volatility

Silver ETFs Plunge 20% Amid Volatility

22 Jan

Summary

- Silver ETFs dropped up to 20% due to high volatility.

- Global spot silver held steady near record highs.

- Market sentiment shifted due to dollar strength and easing tensions.

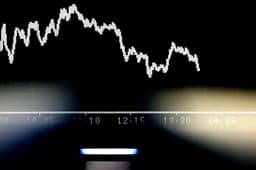

Indian silver exchange-traded funds (ETFs) experienced a severe downturn on Thursday, with some funds dropping as much as 20%. This significant drop led to a reversal, causing ETFs to trade at a discount to their net asset values (iNAVs) and international prices. The sell-off was primarily concentrated in the ETF market, as physical silver and international spot markets showed far less dramatic declines. Global spot silver remained near its recent record highs, while domestic futures saw only minor drops.

The retreat in silver ETFs occurred as the U.S. dollar strengthened and global risk appetite improved, diminishing the appeal of safe-haven assets like silver. Easing geopolitical tensions, following statements from U.S. President Donald Trump, contributed to profit-booking in precious metals. Experts advised caution and suggested waiting for market stability before making new investments.

Despite the recent turbulence, some analysts maintain a bullish outlook on COMEX Silver, citing robust industrial demand and ongoing safe-haven flows amid tightening global supply. Support levels for silver were identified at $84 per troy ounce, with resistance anticipated between $94.60-$96.80.