Home / Business and Economy / AI Threatens $1 Trillion SaaS Market: SaaSpocalypse Looms?

AI Threatens $1 Trillion SaaS Market: SaaSpocalypse Looms?

14 Feb

Summary

- AI's emergence caused a $1 trillion market value drop in SaaS companies in one day.

- New AI tools like ChatGPT and Claude are disrupting insurance and financial services.

- Despite fears, some analysts see potential bargains as AI's impact is still unfolding.

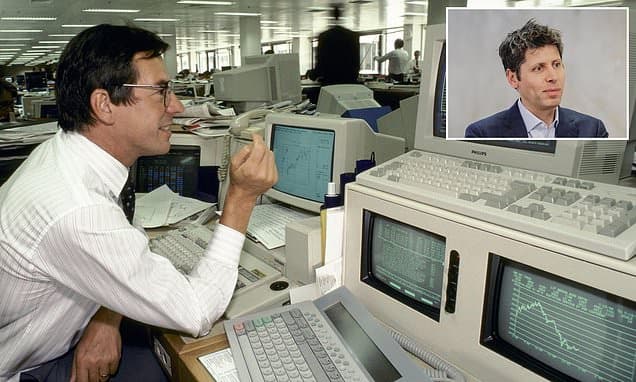

A dramatic $1 trillion erosion in market value for software-as-a-service (SaaS) companies occurred recently, sparking concerns of a 'SaaSpocalypse.' This significant downturn is attributed to the rapidly advancing capabilities of artificial intelligence (AI) and its potential to disrupt not only software firms but also the information service sector. Major players and smaller companies alike have witnessed substantial share price declines, including French group Dassault Systemes and UK comparison sites Money and Future.

New AI systems like OpenAI's ChatGPT and Anthropic's Claude are increasingly demonstrating the ability to offer services that could challenge existing business models. For instance, Insurify uses AI to find better car insurance deals, and Altruist leverages AI for financial planning strategies. This has led to investor anxiety, with analysts noting a period of significant uncertainty regarding the next 12 to 24 months.

Despite the turmoil, some experts believe AI may enhance rather than displace software products, drawing parallels to the development of tools. There's a growing debate about whether this AI-driven market shift presents opportunities for investors, with some suggesting that certain software stocks may now represent undervalued 'buys.' Companies like Relx and London Stock Exchange Group are being analyzed for their potential resilience and AI integration strategies.

Innovations from AI developers like OpenAI and Anthropic are poised for significant market entry, with potential valuations reaching hundreds of billions of dollars. While these advancements promise to democratize complex tasks, they also amplify anxieties about the responsible management of such powerful technologies. Investors are advised to closely monitor their portfolios as the long-term effects of AI on various industries continue to unfold.