Home / Business and Economy / CEO Buys Stock, Raspberry Pi Shares Surge 42%

CEO Buys Stock, Raspberry Pi Shares Surge 42%

17 Feb

Summary

- Raspberry Pi shares surged 42% after CEO purchased stock.

- AI demand is speculated to be driving interest in the company.

- The stock remains 50% below its record high from the previous year.

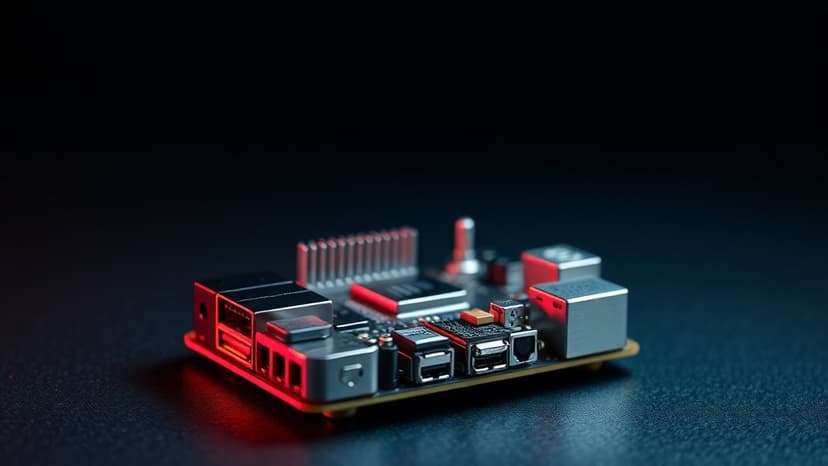

Shares of UK computer hardware firm Raspberry Pi experienced a dramatic two-day rally, soaring up to 42% after CEO Eben Upton acquired stock. This significant rebound, beginning on Monday, February 17, 2026, followed a filing revealing Upton's purchase of approximately 13,224 pounds worth of shares. The company's stock price is still approximately 50% lower than its record high set a year ago.

The recent surge has been accompanied by growing chatter on social media platforms, suggesting that demand for Raspberry Pi's single-board computers might increase. This is attributed to their potential use in low-cost artificial intelligence projects, such as running AI agents. One popular X user highlighted Raspberry Pi as a "Fun Trade Idea," noting that buyers are reportedly hoarding the devices due to their significantly lower cost compared to more expensive alternatives.

In response to the share price activity, Raspberry Pi stated that there were no new company announcements beyond publicly available information. As of 14:54 GMT on Tuesday, the shares were up approximately 27%, positioning them as top gainers on the FTSE 250 index. Earlier in February 2026, the stock had briefly fallen below its initial public offering price of 280 pence. Earlier in January 2026, Raspberry Pi had projected that its 2025 core earnings would exceed expectations, but cautioned that supply and pricing volatility for memory components could cloud its outlook for 2026.