Home / Business and Economy / Investors Eye Non-China Rare Earths

Investors Eye Non-China Rare Earths

1 Jan

Summary

- China dominates global rare earth mining and processing.

- Neo Performance Materials stock up 108% year-to-date.

- Company reported strong earnings beat in its latest quarter.

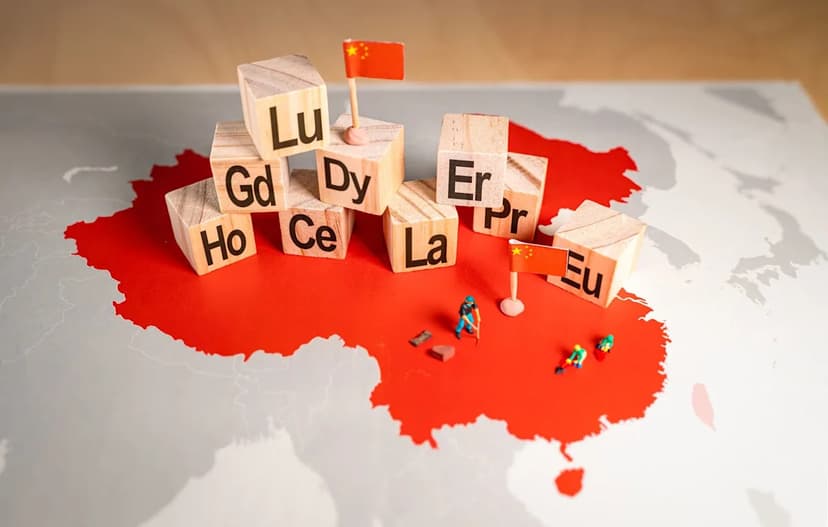

China's dominant position in rare earth mining and processing, controlling nearly 70% of mining and 90% of processing, has prompted a global investment shift towards non-Chinese alternatives. This move is driven by supply chain control concerns, especially with materials vital for electric vehicles and electronics.

Neo Performance Materials (NOPMF), a Canada-based producer of rare earth materials and magnets, has emerged as a key public-market proxy. As of December 30, 2025, the company's stock has achieved an impressive 108% year-to-date gain, despite a recent 19% slide in the past three months.

The company's latest earnings report, released on November 13, detailed a significant earnings per share beat for the quarter ending September 25, 2025, and a notable year-over-year revenue increase. This financial strength has contributed to a premium valuation, as investors are willing to pay more for NOPMF's exposure to the rare earth market and its positive earnings momentum.