Home / Business and Economy / Personal Assets Trust: Wealth Preservation in Volatile Markets

Personal Assets Trust: Wealth Preservation in Volatile Markets

7 Dec

Summary

- Fund focuses on long-term wealth preservation, not just growth.

- Generated positive returns in 14 out of 17 years under Troy.

- Portfolio leans back from risk, reducing losses in market downturns.

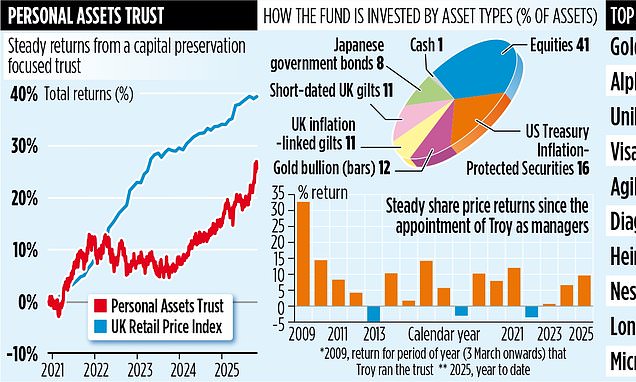

Personal Assets Trust, a £1.7 billion fund managed by Troy Asset Management since early 2009, centers its investment philosophy on preserving shareholder wealth. This approach prioritizes protecting investors' real wealth over solely aiming for capital appreciation. The trust's strategy has yielded positive returns in 14 out of the 17 calendar years it has been managed, demonstrating a consistent track record.

The fund employs a defensive stance, aiming to lose less value than the broader market during significant downturns. For example, during the 2007 financial crisis, its share price drop was considerably less severe than major market indices. This strategy involves investing across a diverse range of assets, including equities, bonds, and gold, to balance risk and return.

Recently, the trust modestly increased its equity exposure to 41%, seeking resilient companies at attractive valuations, particularly those not driven by the current AI hype. A significant portion remains in inflation-linked bonds, offering stability without exposure to potential yield increases from bond market concerns.