Home / Business and Economy / Paramount Skydance Stock Plunges Amid Hostile Bid Concerns

Paramount Skydance Stock Plunges Amid Hostile Bid Concerns

19 Dec, 2025

Summary

- Paramount Skydance stock has fallen 36.7% from its 52-week high.

- Analysts issued 'Sell' ratings citing valuation concerns and debt.

- PSKY stock underperformed Nasdaq but outperformed Disney over 52 weeks.

Paramount Skydance Corporation, a New York-based media giant with a $14.8 billion market cap, is facing significant investor skepticism. Shares have plummeted 36.7% from their 52-week high of $20.86, reached on September 23. This decline, coupled with a 25.9% drop over the last three months, significantly trails the Nasdaq Composite's performance.

Analysts recently downgraded PSKY, issuing 'Sell' ratings after the company's hostile bid for Warner Bros. Discovery. Concerns focus on the offer's valuation and the potential strain on PSKY's already high debt. The stock has traded below its 200-day moving average since mid-December, signaling a bearish trend.

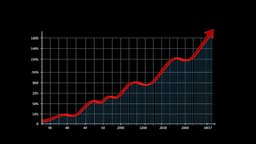

Despite these short-term challenges, PSKY has demonstrated long-term strength, gaining 22.9% over the past 52 weeks, outperforming the Nasdaq. The consensus among 20 analysts is a 'Moderate Sell,' with a mean price target suggesting a modest upside from current levels.