Home / Business and Economy / NZ Housing Market Set for 5% Rise in 2026

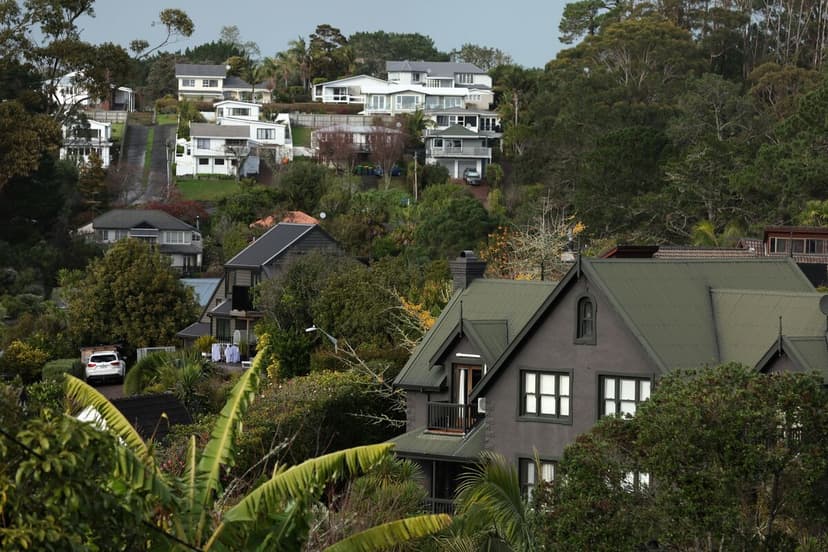

NZ Housing Market Set for 5% Rise in 2026

6 Jan

Summary

- New Zealand house prices are predicted to rise by 5% in 2026.

- Interest rate cuts and economic recovery signs boost market optimism.

- Buyers are cautioned due to potential rising home-loan rates.

New Zealand's property market is showing signs of recovery, with forecasts predicting a 5% rise in house values for 2026 after a period of stagnation. Property consultancy Cotality indicated that after two years of falling prices, property values are expected to begin climbing again next year. This optimistic outlook is primarily driven by a notable decrease in interest rates and encouraging indicators of an economic rebound. The nation's GDP saw a significant lift in the third quarter, bolstering confidence for potential buyers in the coming months.

Mortgage interest rates reached their lowest point in over three years by November, a result of aggressive rate cuts by the Reserve Bank. However, this positive trend is being tempered by emerging concerns. Investor expectations of potential rate hikes later in the year have already caused wholesale borrowing costs to increase, prompting banks to raise home-loan rates for longer-term fixed periods. This shift suggests that while short-term rates have been favorable, future borrowing costs might escalate.

Despite the headwinds, Kelvin Davidson, chief property economist at Cotality, suggests that 2026 could be a stronger year for the housing market than 2025. Buyers are encouraged to proceed with caution, considering factors such as potential increases in home-loan rates, a jobless rate at a five-year high, and the inherent volatility of an election year. Households will need to make careful decisions regarding their mortgages, especially with the recent adjustments to longer-term fixed rates.