Home / Business and Economy / Is It Finally Time to Buy Nvidia Stock?

Is It Finally Time to Buy Nvidia Stock?

16 Dec, 2025

Summary

- Nvidia stock slumped 12% from its October high due to AI hype concerns.

- WSJ warns rivals' lower-priced chips could threaten Nvidia's AI near-monopoly.

- Despite competition, major tech firms still heavily rely on Nvidia GPUs.

After a remarkable five-year surge of approximately 1,300%, Nvidia stock has recently seen a notable correction. The shares have shed 12% of their value since hitting an all-time high in October, primarily due to investor worries about the sustainability of AI enthusiasm and the potential for a market bubble.

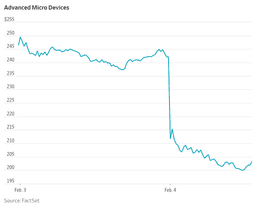

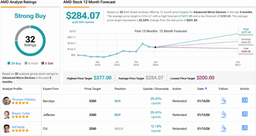

Concerns are mounting as rivals, including Advanced Micro Devices and Alphabet, are developing AI chips at lower price points. The Wall Street Journal warned that Nvidia's substantial operating profit margins, exceeding twice those of other semiconductor companies, could invite a price war that might disrupt its near-monopoly in AI chips.

Despite these competitive pressures and the introduction of alternative technologies, Nvidia's position remains robust. Even as some companies explore other options, major players like Alphabet continue to spend billions annually on Nvidia's GPUs. This sustained demand indicates that Nvidia's technology remains critical, even as the market evolves.