Home / Business and Economy / Nvidia Soars Ahead: Wall Street Analysts Bullish on Q3 Earnings

Nvidia Soars Ahead: Wall Street Analysts Bullish on Q3 Earnings

17 Nov

Summary

- Morgan Stanley analyst raises Nvidia's price target to $220

- Nvidia expected to post 54% earnings growth and 56% revenue jump in Q3

- Blackwell AI chip remains the industry's top choice

As of November 17, 2025, Nvidia (NVDA) stock is garnering significant attention from Wall Street analysts, who have reaffirmed their bullish stance ahead of the company's highly anticipated Q3 earnings report on November 19.

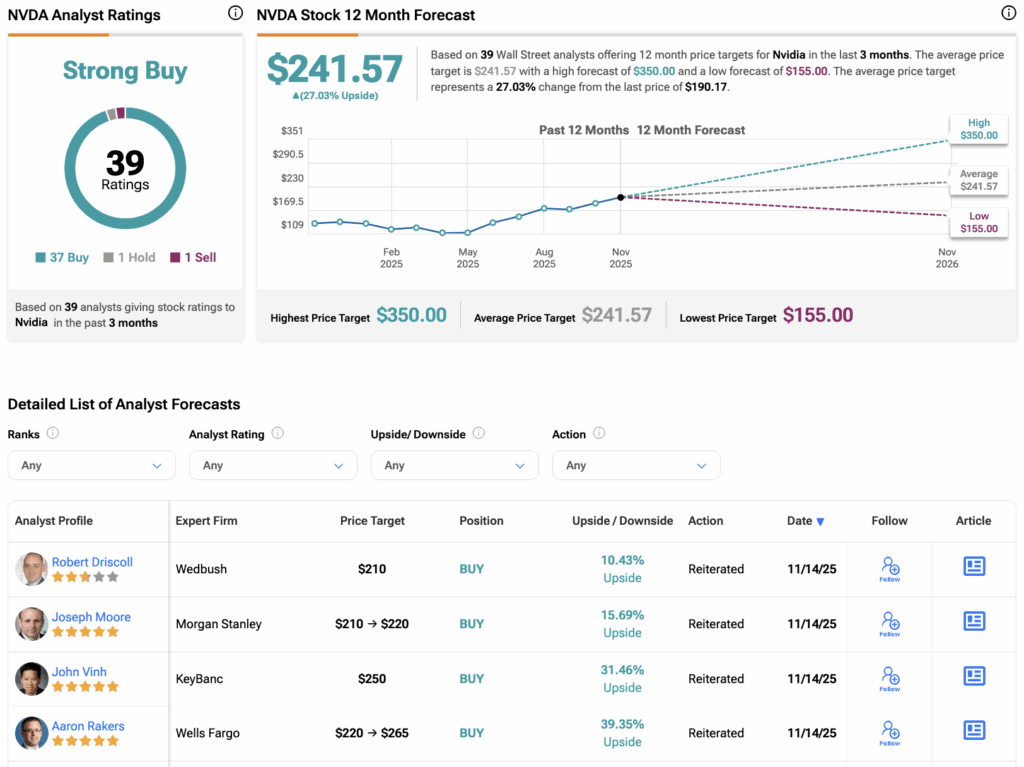

Notably, five-star-rated analyst Joseph Moore at Morgan Stanley has raised his price target on NVDA from $210 to $220, while maintaining his Buy rating. Moore expects Nvidia to deliver "the strongest result seen in the last few quarters," with Wall Street forecasting earnings of $1.25 per share for Q3 FY26, up 54% from the same quarter last year. Analysts also predict $54.79 billion in revenue, representing a year-over-year jump of more than 56%.

Ahead of the Q3 release, Moore stated that industry checks point to a material acceleration in demand. He expects Nvidia to deliver solid Q3 results as the Blackwell platform moves into full production. Moore noted that Blackwell remains the AI chip of choice, while early demand signals for Vera Rubin, Nvidia's upcoming AI accelerator line, are "very strong."

Despite Nvidia's recent underperformance versus AI peers, Moore believes this trend should reverse, adding that even after lifting estimates above Street expectations, his outlook remains "conservative." The analyst also highlighted comments from CEO Jensen Huang, who suggested that estimates for the next five quarters may need to increase by roughly $70-$80 billion.