Home / Business and Economy / Netflix Stock Plunges: Is the Worst Over?

Netflix Stock Plunges: Is the Worst Over?

30 Dec

Summary

- Netflix shares fell 20% in Q4, underperforming the S&P 500.

- October earnings report missed expectations despite record revenue.

- Investor confidence is shaken by growth doubts and M&A uncertainty.

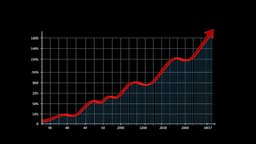

As 2025 concludes, Netflix Inc. faces significant investor headwinds, with its stock experiencing a roughly 20% decline in the final quarter. This performance starkly contrasts with the S&P 500's positive gains, leaving Netflix trading near its value from a year prior. The sell-off stems from a broad loss of investor confidence, amplified by doubts surrounding the company's ability to sustain historical growth rates and unease regarding its potential acquisition of Warner Bros. Discovery.

October's earnings report, while delivering record revenue, missed earnings per share expectations, further unsettling markets. This miss undermined confidence in near-term execution and revived concerns about the sustainability of Netflix's growth. Such uncertainty, especially when investor expectations are high, often triggers sharp market reactions, even when the broader market remains robust. Sentiment has swung decisively negative, pushing Netflix's stock lower.

Compounding these issues, Netflix's bid for Warner Bros. Discovery introduced further M&A uncertainty. The situation intensified with a competing offer from Paramount-Skydance, although Netflix's proposal is reportedly favored by the Warner Bros. board. These combined factors have clouded the company's future outlook, contributing to the current market sentiment.