Home / Business and Economy / Mining's Future: 2026 Sees Shift From Single Themes

Mining's Future: 2026 Sees Shift From Single Themes

17 Dec, 2025

Summary

- Mining sector to shift from single-theme investing in 2026.

- Uranium prices expected to rise due to supply constraints.

- Copper prices to remain elevated amid structural supply deficits.

In 2026, the mining industry is expected to pivot from single-theme investment strategies, embracing a more diversified approach shaped by distinct market forces. This shift signals a complex macroeconomic landscape influenced by geopolitical tensions, fiscal policies, and persistent inflation, all impacting commodity markets significantly.

The outlook for 2026 highlights a "looming uranium squeeze," with prices predicted to rise as supply remains tight and utility demand, particularly in the U.S., escalates. Concurrently, copper is expected to maintain elevated prices around $12,000 per tonne, supported by persistent supply deficits and delayed project timelines. These factors will likely necessitate more active portfolio management by investors.

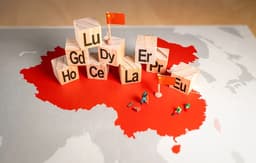

Furthermore, 2026 is anticipated to usher in the initial phase of a renewed capital investment cycle, beginning with gold projects and extending to copper. This trend, coupled with the ongoing focus on critical minerals like rare earths and tin for supply chain de-risking, suggests a dynamic year for mining equities and strategic mergers and acquisitions.