Home / Business and Economy / Memory Chip Squeeze: Winners Soar, Tech Stocks Slump

Memory Chip Squeeze: Winners Soar, Tech Stocks Slump

10 Feb

Summary

- Memory chip prices have surged, creating a stock market divide.

- AI infrastructure spending is intensifying memory chip shortages.

- Some companies' shares have slumped due to profitability concerns.

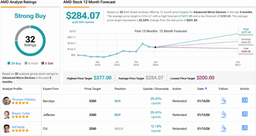

The stock market is experiencing a significant divide driven by soaring memory chip prices. Memory producers are achieving unprecedented heights, while companies reliant on these chips, such as PC brands and console makers, are facing declining share prices due to profitability concerns. This situation is expected to continue, with industry tightness potentially lasting through the remainder of 2026.

Massive AI infrastructure spending by hyperscalers is a key factor exacerbating memory chip shortages. This demand shift has led to a 'supercycle' in the memory market, breaking traditional supply and demand patterns. The spot prices for DRAM have seen dramatic increases, even as demand for end-products like smartphones and cars remains weak.