Home / Business and Economy / Utilities Surge, Tech Stocks Tumble Amid Market Volatility

Utilities Surge, Tech Stocks Tumble Amid Market Volatility

14 Feb

Summary

- Utilities sector posted record gains as investors sought traditional safe havens.

- 10-year Treasury note yield dropped to its lowest level since late November.

- Amazon shares experienced their longest daily decline since July 2006.

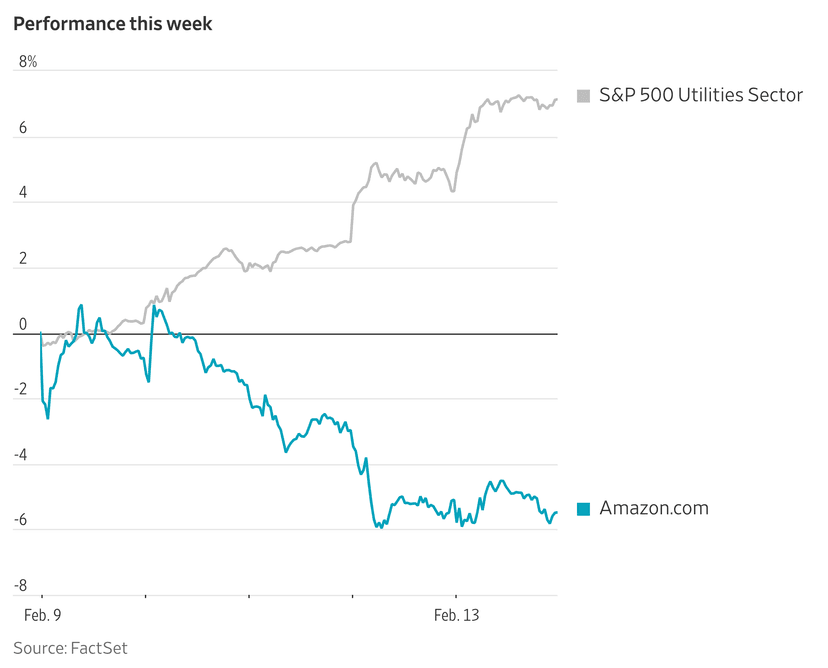

This week, amidst market volatility, investors gravitated towards traditional safe-haven assets. The utilities sector within the S&P 500 achieved a record performance, marking a 7.1% increase. Concurrently, a significant influx into government debt caused the yield on the 10-year Treasury note to fall to 4.055%, its lowest point recorded since November 28.

The indiscriminate selling across the market has presented potential entry points for some investors in stocks that experienced sharp declines. Amazon, for example, saw its shares register their ninth consecutive daily drop on Friday. This extended losing streak, the longest since July 2006, resulted in the retail giant shedding $474 billion in market capitalization.

Investment professionals note that upcoming rate cuts, coupled with falling stock prices amidst widespread investor fear, especially in tech and software, create a "wall of worry." This environment, however, is precisely where opportunities for astute investors can emerge, according to market observers.