Home / Business and Economy / Confusing SMS Triggers ITR Refund Worries

Confusing SMS Triggers ITR Refund Worries

23 Dec, 2025

Summary

- Taxpayers received unclear SMS about ITR refund processing on hold.

- Alert cited 'risk management process' and 'discrepancies' causing concern.

- Deadline to file revised return is December 31.

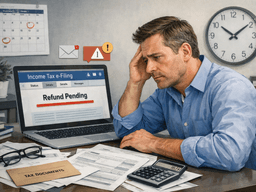

The Income Tax Department has issued an alert causing confusion and concern among taxpayers nationwide. Recent SMS messages indicate that ITR refund claims have been flagged under a "risk management process" due to "certain discrepancies," leading to processing being temporarily halted.

Many taxpayers, including compliant ones, have reported receiving these messages, often late at night, without corresponding detailed emails. These alerts specifically mention a deadline of December 31 for filing a revised return. Experts suggest these alerts are internal prompts for additional checks on claims like donations or foreign assets, not formal scrutiny notices.

While the department intends to send specific details via email soon, many have not yet received them. Taxpayers are advised to review their ITR, ensure all claims are documented, and file a revised return if necessary before December 31. Genuine taxpayers with correct filings and supporting documents have been assured there is no cause for panic.