Home / Business and Economy / Interest Rates to Surge: Homeowners Brace for 2026 Shock

Interest Rates to Surge: Homeowners Brace for 2026 Shock

5 Jan

Summary

- Economists predict sharp interest rate hikes in 2026, ending relief hopes.

- Inflation remains above target, prompting Reserve Bank to consider rate increases.

- Housing and services costs are escalating due to shortages and population growth.

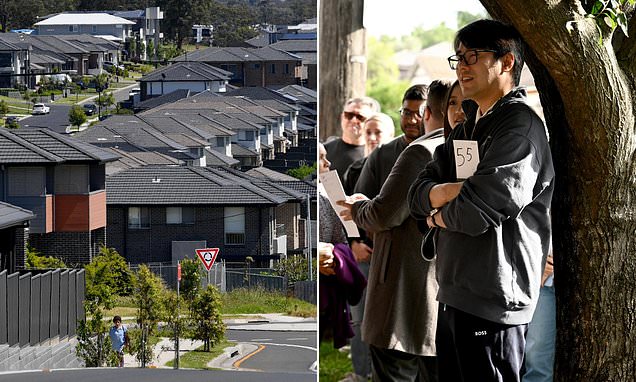

Millions of homeowners are facing a difficult financial year as economists forecast significant interest rate increases in 2026. Expectations of any rate relief have been dashed, with the Reserve Bank widely predicted to abandon rate cuts this year due to persistent inflation.

Several major banks anticipate rate hikes before June, with inflation figures unexpectedly spiking to 3.8% in October, exceeding the RBA's target band. This has caused market volatility, shifting from expecting cuts to betting on increases, driven by soaring housing and service costs.

Despite a cooling property market in some major cities, with growth slowing and prices falling in Sydney and Melbourne, the overall trend points towards continued financial pressure for homeowners. National home prices saw minimal growth in December, but underlying inflationary pressures remain.