Home / Business and Economy / Inflation's Shadow: A 1970s Echo Looms

Inflation's Shadow: A 1970s Echo Looms

24 Dec, 2025

Summary

- Inflation resurgence fears mirror 1970s economic conditions.

- Fading Chinese deflation and rising tariffs increase prices.

- Significant government spending is expected to boost demand.

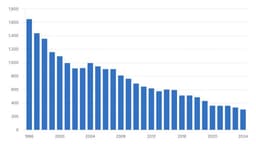

As stock markets near historic highs, a potential resurgence of inflation is emerging as a significant concern for investors. Analysts point to parallels with the economic conditions of the 1970s, noting that while specific factors differ, the overall pattern may be repeating. Notably, China's role as an exporter of deflation has waned, while increased global tensions and tariffs are contributing to rising prices.

Furthermore, a global trend of "fiscal largesse" is evident, with major economies like the United States and Germany anticipating substantial budget deficits and spending increases. This surge in government spending is expected to amplify aggregate demand. Simultaneously, global supply chains remain constrained, creating a scenario where increased demand could outpace supply, thus pushing prices upward.

In light of these inflationary concerns, investment strategies may need adjustment. Holding longer-term bonds is considered a risky proposition in such an environment. Instead, attention is shifting towards shorter-duration bonds, which may offer a more favorable risk-reward profile as investors navigate the evolving economic landscape.