Home / Business and Economy / India's TV Empire Crumbles: Streaming Reigns Supreme

India's TV Empire Crumbles: Streaming Reigns Supreme

31 Dec

Summary

- Pay TV lost 40 million subscribers since 2018, down to 111 million by 2025.

- JioStar merger creates media giant, controlling TV and streaming.

- Heartland India and free TV resist streaming's urban dominance.

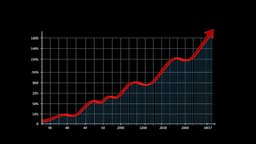

India's pay-television sector experienced a significant contraction, shedding 40 million subscribers between 2018 and the end of 2025, reducing its base to 111 million. This decline is largely attributed to the aggressive growth of over-the-top (OTT) streaming platforms. The media landscape was further reshaped by the November 2024 merger of Reliance Industries and Walt Disney Company, forming JioStar, an entertainment powerhouse commanding both linear TV channels and streaming services like the dominant JioHotstar.

While the urban population increasingly embraces streaming, linear television, especially free-to-air channels like DD Free Dish and free-to-air cable, continues to hold strong in tier-two, tier-three, and rural areas. These segments offer a cost-effective alternative for millions, demonstrating a stark viewing pattern split between metro streaming habits and the more traditional, appointment-based viewing prevalent in the heartland.