Home / Business and Economy / Indian Markets Hit Record Highs, Then Fall Back

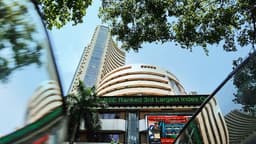

Indian Markets Hit Record Highs, Then Fall Back

6 Jan

Summary

- Indian stock indices reached record highs but closed lower on Monday.

- Asian markets rallied strongly, shrugging off geopolitical concerns.

- HDFC Bank's decline and Nifty IT sector fall contributed to the index dip.

India's benchmark stock indices soared to all-time highs on Monday, but the momentum couldn't be sustained, leading to a lower close. The NSE Nifty reached a record 26,373.2 before settling at 26,250.30, down 0.3%. The BSE Sensex hit an unprecedented 85,883.5, ultimately closing at 85,439.6, a 0.4% decline.

This market movement occurred despite a strong rally across Asian markets, which shrugged off geopolitical developments. South Korea and Taiwan saw significant gains driven by technology and AI optimism, while Japan and China also posted advances. Brent crude futures saw a modest increase to $61.10 a barrel, with analysts noting that a lack of a crude oil price spike limited the impact of US-Venezuela concerns.

Analysts pointed to profit-taking at higher levels as a primary reason for the Indian market's decline, with HDFC Bank falling 2.3% and the Nifty IT index dropping 1.4%. Despite the day's pullback, the overall market sentiment remains bullish, with some predicting further upside for the Nifty in the near term.