Home / Business and Economy / India's Wealth Protection Gap: Succession Planning Crisis?

India's Wealth Protection Gap: Succession Planning Crisis?

30 Nov

Summary

- Succession planning is crucial for wealth protection and widely neglected.

- Over ₹2 lakh crore is unclaimed due to missing succession plans.

- Early succession planning ensures wealth protection for promoter families.

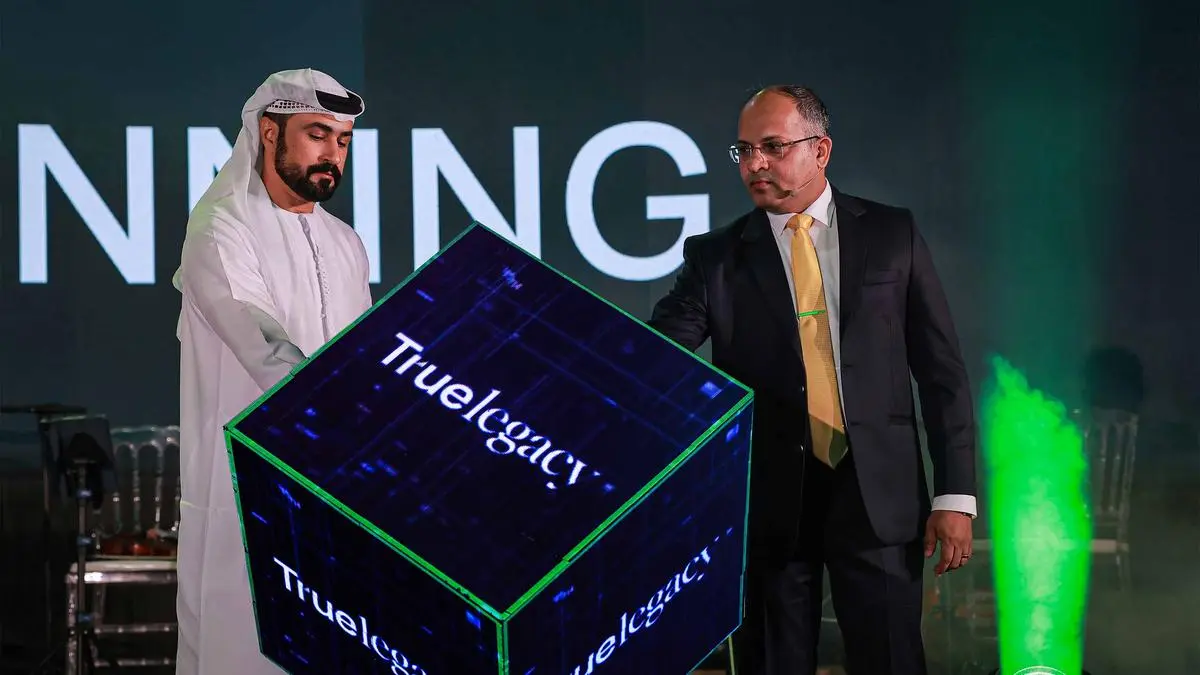

A pioneering brand, True Legacy, has been launched in India by business consultancy Capitaire, focusing exclusively on succession planning for individuals, families, and business owners. Founder Sreejith Kuniyil stressed that succession planning is a vital, yet often overlooked, aspect of wealth protection, as crucial as regulatory compliance.

Failure to establish a succession plan can lead to government intervention through inheritance laws, effectively acting as a financial disservice to dependents. True Legacy aims to offer structured and transparent solutions, addressing the alarming reality of over ₹2 lakh crore in unclaimed bank deposits, insurance proceeds, and investments due to inadequate planning.

Industry leaders like Navas Meeran, chairman of Group Meeran, echoed the sentiment, highlighting early succession planning as essential for protecting promoter families' wealth and advising early involvement of the next generation. A recent conclave discussing continuity and wealth protection also saw the release of Kuniyil's book, attracting over 450 business owners.