Home / Business and Economy / Buyer's Market Emerges, But Buyers Are Absent

Buyer's Market Emerges, But Buyers Are Absent

7 Dec, 2025

Summary

- Nationwide, sellers outnumbered buyers by 37% as of October.

- Home prices remain over 50% higher than pre-pandemic levels.

- Mortgage rates are still above 6%, deterring buyers.

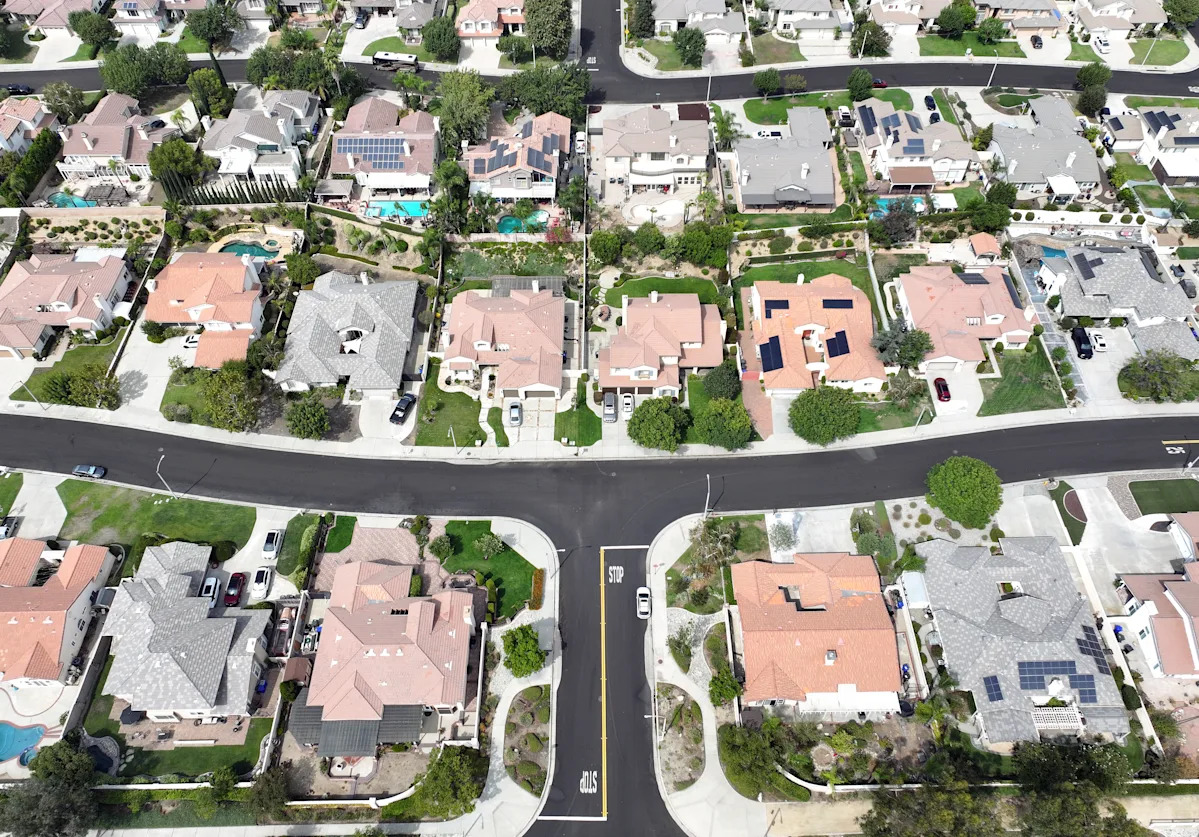

Homebuyers are experiencing a notable shift in market dynamics as the year concludes, with mortgage rates near their lowest points and buyer-favored conditions expanding across numerous metropolitan areas. However, this potential advantage is largely unmet, as many of these emerging buyer's markets lack sufficient buyer interest.

Nationwide, a surplus of sellers was evident by October, with Redfin reporting sellers outnumbering buyers by 37%. This trend signifies the strongest buyer's market observed since at least 2013, typically offering buyers more inventory and limiting home price appreciation. Despite these favorable conditions, persistent economic anxieties and high costs are causing buyers to retreat faster than sellers are adjusting.

This scenario highlights how even marginal improvements in affordability are insufficient to revitalize a housing market where prices have surged over 50% since pre-pandemic times and mortgage rates remain above 6%. Consequently, many prospective buyers, particularly first-time purchasers, find themselves effectively excluded. Home sales this year are projected to remain near 30-year lows for the third consecutive year, reflecting ongoing affordability challenges.