Home / Business and Economy / BDC Stocks: High Yields for 2026?

BDC Stocks: High Yields for 2026?

13 Dec, 2025

Summary

- BDCs offer high, reliable dividends by distributing earnings.

- Analyst sees unwarranted underperformance in BDC stocks.

- Trinity Capital is a BDC with a 13% potential yield.

As investors prepare their portfolios for 2026, Business Development Companies (BDCs) are emerging as attractive options for high dividend yields. BDCs specialize in financing small and medium-sized businesses, benefiting from tax advantages that encourage the distribution of earnings to shareholders. This structure typically results in substantial and consistent dividend payouts.

Industry analysts suggest that recent underperformance in the BDC sector is unwarranted, with underlying fundamentals remaining healthy. This perspective indicates a potential buying opportunity for investors looking for strong dividend payers and an attractive entry point into the market.

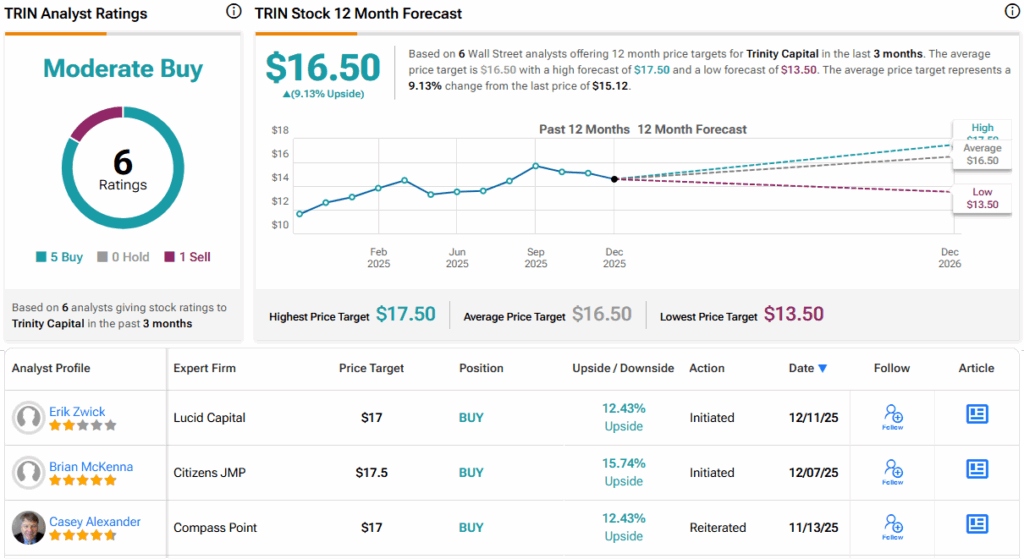

Trinity Capital (TRIN) is identified as a key BDC opportunity, noted for its potential 13% yield. This alternative asset manager provides credit market access to client firms and aims for stable returns for its investors through its investments in various sectors like tech, life sciences, and asset-based lending.