Home / Business and Economy / Goldman Sachs Earnings: Expect a Dip?

Goldman Sachs Earnings: Expect a Dip?

15 Jan

Summary

- Goldman Sachs expected to report a 2.1% earnings per share decline.

- Revenue is projected to increase by 3.2% to $14.32 billion.

- Analysts offer mixed ratings, with price targets varying significantly.

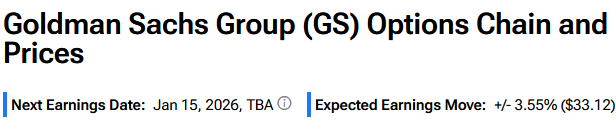

Goldman Sachs is scheduled to release its fourth-quarter 2025 financial results on January 15, 2026. Wall Street consensus forecasts earnings per share of $11.70, a 2.1% decrease from the previous year, with revenues projected to climb 3.2% to $14.32 billion. The bank's performance is expected to be bolstered by strong merger and acquisition advisory fees, though a downturn in private banking revenue and increased compensation expenses may temper overall gains.

Leading up to the earnings report, analyst sentiment is divided. Bank of America has raised its price target for Goldman Sachs stock to $1,050 with a Buy rating, highlighting strong financing revenues. Conversely, HSBC has lowered its price target to $604, maintaining a Hold rating while increasing EPS estimates for the sector.

Options market data suggests traders are anticipating a movement of approximately 3.55% in Goldman Sachs stock following the earnings release. TipRanks' AI Analyst holds a bullish Outperform rating with a $1,068 price target, citing operational strength and positive market trends.