Home / Business and Economy / Gold Shatters 40-Year Inflation-Adjusted Record

Gold Shatters 40-Year Inflation-Adjusted Record

26 Jan

Summary

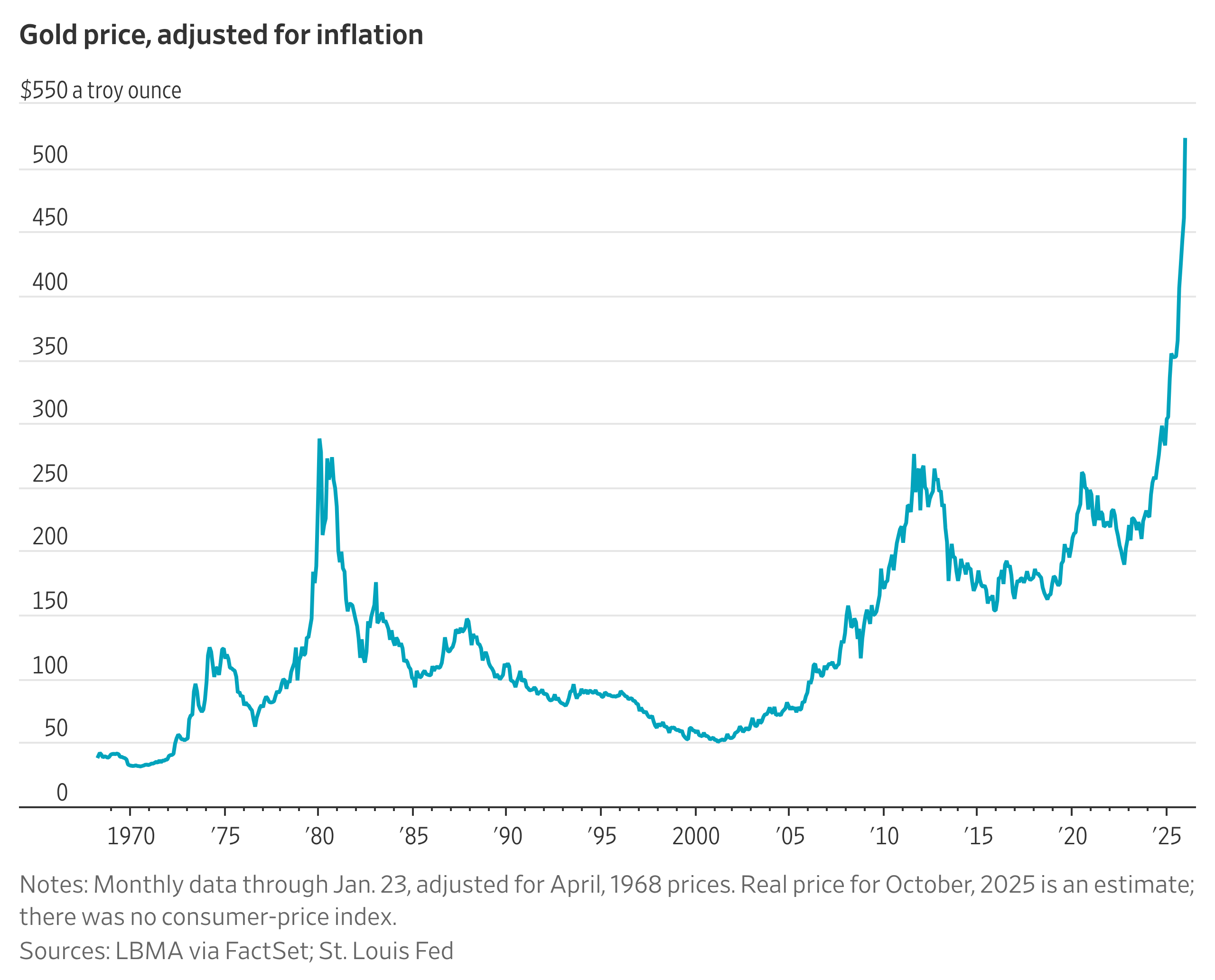

- Gold surpassed its inflation-adjusted high from early 1980 last year.

- Gold has surged 17% in 2026 and 83% over the past 12 months.

- Investor concerns about interest rates and central bank demand fuel gold's rise.

Gold has achieved a new inflation-adjusted high, shattering a record that had stood for over four decades. This significant milestone was reached last year, with the precious metal continuing its upward trajectory. As of early 2026, gold has appreciated by 17% this year and a remarkable 83% over the preceding 12 months.

The current market environment is characterized by investor apprehension regarding potential interest rate policies. Unlike the aggressive rate hikes under Paul Volcker in 1980 to combat inflation, there is concern that current monetary policy might favor lower rates, influenced by political desires. This uncertainty is a key driver of gold's performance.

Furthermore, escalating geopolitical tensions and strategic gold acquisitions by foreign central banks, aimed at mitigating the impact of sanctions, are also contributing to gold's strong market position. The article also notes an even more dramatic increase in silver prices, boosted by both its perceived safe-haven status and substantial demand from the renewable energy industry.