Home / Business and Economy / $600T Wealth: Is It Real or Just Paper?

$600T Wealth: Is It Real or Just Paper?

23 Dec, 2025

Summary

- Global wealth reached $600 trillion, fueled by asset price hikes, not real investment.

- Over a third of wealth growth since 2000 was 'paper gains,' disconnected from the economy.

- The top 1% holds 35% of U.S. wealth, widening the gap with everyday Americans.

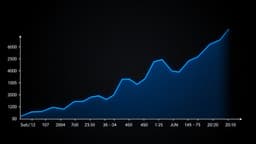

Global wealth has surged to an unprecedented $600 trillion, yet this accumulation is increasingly detached from real economic growth. A significant portion of this wealth increase, over a third since the turn of the century, originated from asset price inflation rather than new investments or savings. This phenomenon is largely driven by quantitative easing policies from major central banks, creating an 'everything bubble' across various asset classes.

The current economic landscape reveals a stark wealth concentration. In the United States, the top 1% now possesses 35% of the nation's wealth, a figure mirrored in other developed nations. This concentration arises as asset ownership itself becomes a primary driver of wealth accumulation. Individuals holding stocks, real estate, and other appreciating assets benefit from price increases disconnected from underlying economic output.

Consequently, those without substantial asset holdings risk falling further behind, irrespective of their income or savings efforts. This dynamic exacerbates inequality, where paper wealth gains disproportionately accrue to the already affluent. Entering 2025, the global financial system grapples with this imbalance, where much of the recorded wealth is sustained by asset values rather than robust economic productivity.