Home / Business and Economy / Global Finance Flying Blind: Data Gaps Hide Looming Risks

Global Finance Flying Blind: Data Gaps Hide Looming Risks

16 Feb

Summary

- Private capital's growth obscures key economic warning signals.

- Regulators struggle to assess risks due to significant data gaps.

- Increased private finance poses a systemic risk in downturns.

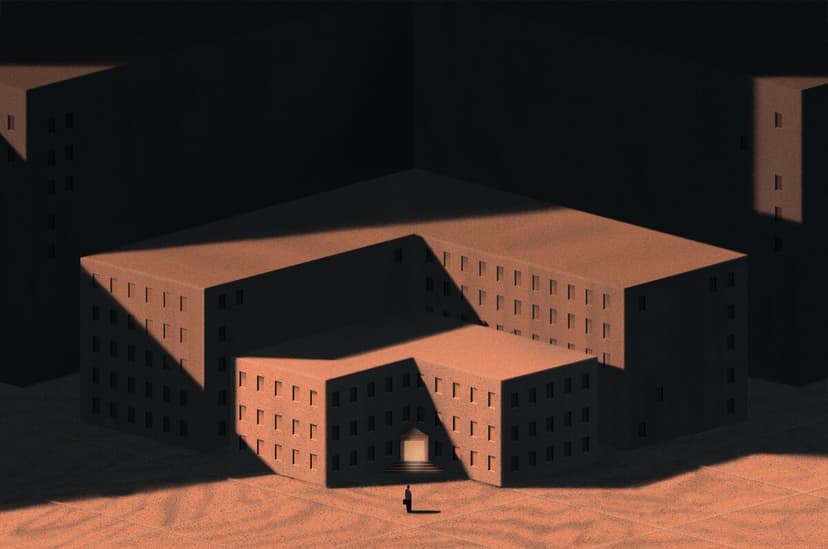

Predicting economic downturns is becoming more challenging due to a growing lack of crucial information within the financial system. A significant shift towards private capital has reduced the availability of traditional economic indicators, such as public company earnings and major transaction data.

This opacity is particularly concerning as private credit expands, replacing traditional bank loans. Officials, like Sarah Breeden from the Bank of England, highlight that these "significant data gaps" make it difficult to identify building risks. Consequently, institutions are resorting to stress tests for the non-banking system to proactively uncover vulnerabilities.

Experts like Elizabeth McCaul note that this trade-off of transparency for speed in private finance leaves policymakers ill-equipped during downturns. The complexity of private credit financing, with its concentrated assets and uncertain valuations, further complicates risk assessment. This lack of visibility mirrors concerns raised by the Financial Stability Board regarding the funding models and default repercussions within private finance.

Recent events, such as the implosion of Archegos Capital Management in 2021 and the 2025 collapses of direct lenders First Brands Group and Tricolor Holdings, underscore the dangers of opaque markets. Regulators are also worried about leveraged bets in Treasury markets and the foreign exchange swaps market, which have previously required massive central bank interventions.

The European Central Bank has also cited data constraints in its analysis of the non-bank sector, emphasizing the need for better data to comprehensively assess risks and interdependencies. The growth of alternative data markets, predicted to reach $135.7 billion by 2030, indicates a burgeoning industry to fill these informational voids, though accessibility and cost remain considerations.

The 2022 liability-driven investment crisis in the UK, partly caused by a lack of data on the pension fund industry, serves as a stark reminder of the amplified stress from concentrated and correlated positions. Without improved data, achieving financial system resilience comparable to the traditional banking sector remains a significant challenge.