Home / Business and Economy / Whale Wakes: 40,000 ETH Move Sparks Market Jitters

Whale Wakes: 40,000 ETH Move Sparks Market Jitters

1 Dec

Summary

- A decade-old Ethereum ICO whale moved 40,000 ETH, valued at $120 million.

- A Yearn Finance exploit triggered a broader crypto market sell-off.

- Over $600 million in crypto liquidations occurred due to leverage unwind.

A significant market event unfolded as a dormant Ethereum ICO wallet, untouched for a decade, moved 40,000 ETH. Originally purchased for a mere $12,400, this stash is now worth approximately $120 million, representing a massive return. Despite initial fears of a sell-off, on-chain analysis suggests this was an internal transfer rather than a liquidation event.

The primary catalyst for the sharp market downturn, however, was a Yearn Finance exploit. This incident, coupled with existing market leverage, led to aggressive unwinding of ETH futures. Over $600 million in cryptocurrency liquidations occurred, forcing many traders out of their positions and contributing to Ethereum's price slide.

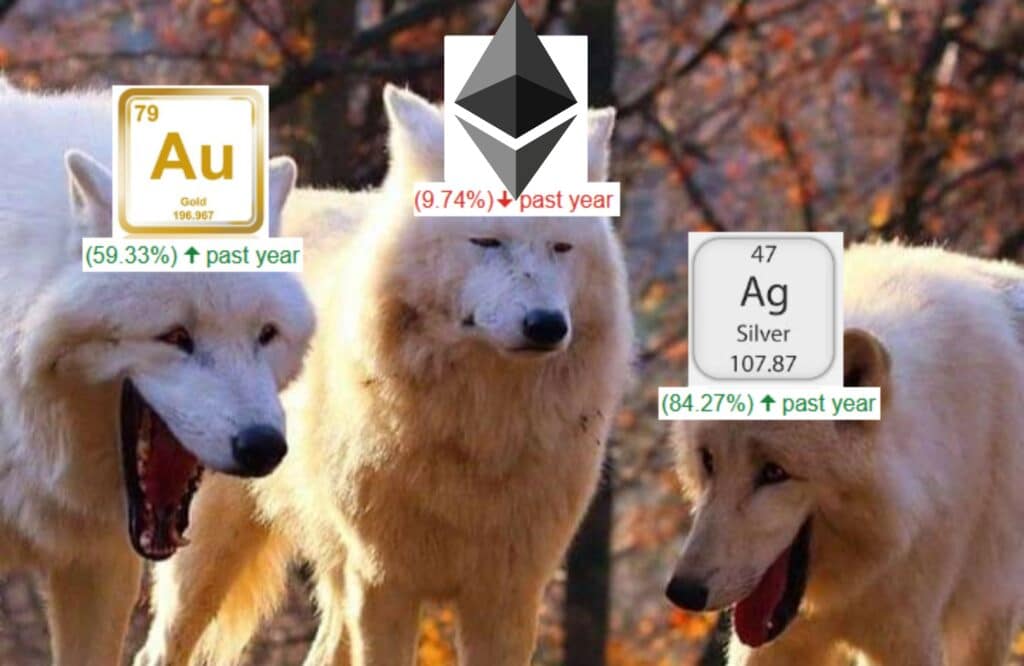

Market conditions remain fragile for Ethereum. Fading spot volume and high leverage indicate potential for continued volatility. Global liquidity trends are also downward, with central banks signaling tightening monetary policies. These factors, combined with the recent exploit and whale activity, paint a cautious picture for Ethereum's price trajectory.