Home / Business and Economy / ETFs Tank: A Blow to Retail Precious Metal Investors

ETFs Tank: A Blow to Retail Precious Metal Investors

31 Jan

Summary

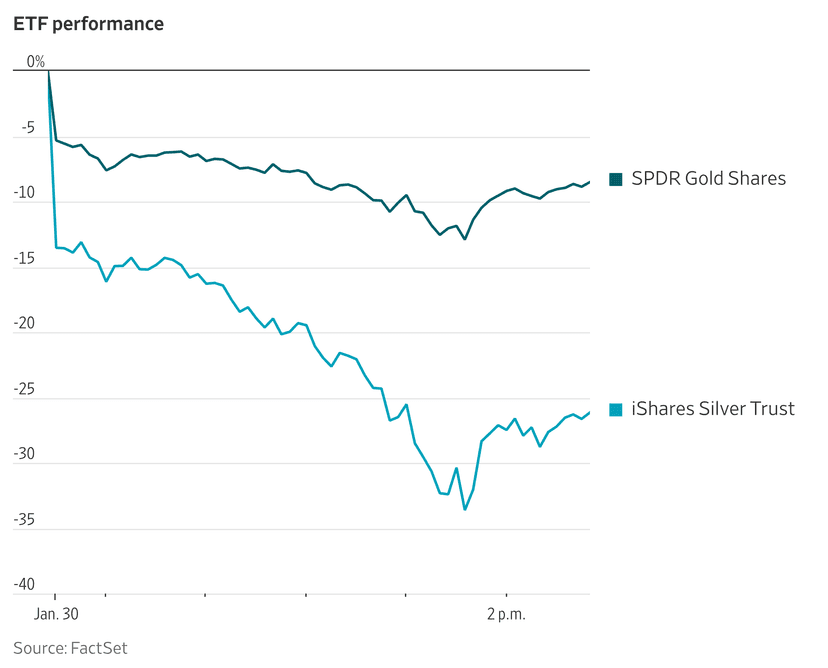

- SPDR Gold Shares saw its largest daily drop since inception.

- The biggest silver ETF had its worst decline since creation.

- Both ETFs remain above their year-to-beginning prices.

Exchange-traded funds (ETFs) that track precious metals experienced a substantial decline on Friday, marking a significant day for retail investors. The SPDR Gold Shares, a prominent gold ETF, recorded its largest daily fall since its inception in November 2004, plummeting by 10%.

In parallel, the iShares Silver Trust, the leading silver ETF, endured its most severe daily drop since its launch in April 2006, with a notable 29% decrease. Despite this sharp downturn, a positive note for investors is that both gold and silver ETFs are still trading at prices higher than they were at the beginning of the year.