Home / Business and Economy / Emerson Electric Boosts Profit, Raises 2026 Outlook

Emerson Electric Boosts Profit, Raises 2026 Outlook

4 Feb

Summary

- First-quarter profit increased, exceeding expectations.

- Company raised its 2026 adjusted per-share profit forecast.

- Strong demand for industrial automation equipment drove growth.

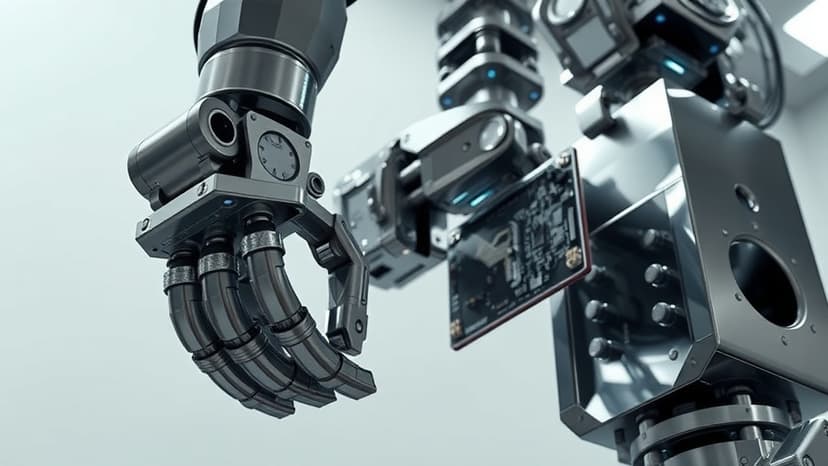

Emerson Electric announced a strong first quarter, with profits exceeding expectations. The company has also elevated the lower end of its adjusted earnings per share forecast for 2026. This positive financial performance is attributed to the sustained high demand for industrial automation equipment.

Demand for Emerson's automation technology remained vigorous throughout the quarter. This was notably boosted by its software and systems business, which experienced a 5% sales increase to $1.45 billion. The company's strategic focus on these areas, coupled with robust sales in key markets like North America, India, and the Middle East and Africa, contributed significantly to its success.

Overall net sales for the first quarter grew approximately 4% compared to the previous year, reaching $4.35 billion, which was in line with analyst predictions. Emerson now anticipates its 2026 adjusted profit to fall between $6.40 and $6.55 per share, a revision from its earlier projection of $6.35 to $6.55 per share.