Home / Business and Economy / Emerging Markets Surge: A Multi-Year Reallocation Begins

Emerging Markets Surge: A Multi-Year Reallocation Begins

22 Dec, 2025

Summary

- Emerging market inflows in 2025 were the strongest since 2009.

- Emerging equities outperformed US peers for the first time since 2017.

- Debt reduction and inflation control fuel investor optimism.

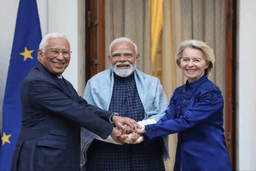

Emerging markets are poised for a multi-year reallocation, with 2025 witnessing the strongest capital inflows into these assets since 2009. This shift signals a significant change after years of underperformance, driven by renewed optimism among investors. Developing economies have made notable progress in debt reduction and inflation control, easing prior concerns.

The trend has seen emerging market equities outperform their US counterparts for the first time since 2017. Major financial institutions project further support from a weakening dollar and increased investment linked to artificial intelligence. JPMorgan forecasts up to $50 billion in inflows into emerging-market debt funds next year.

Despite potential risks like China's deflationary pressures, elevated real yields in emerging markets continue to attract cautious capital. Funds have seen substantial inflows in the recent weeks of December 2025, indicating a window for investors to enter before broader market conviction solidifies.