Home / Business and Economy / Diageo Hires 'Drastic Dave' to Slash Debt and Revive Sluggish Sales

Diageo Hires 'Drastic Dave' to Slash Debt and Revive Sluggish Sales

11 Nov

Summary

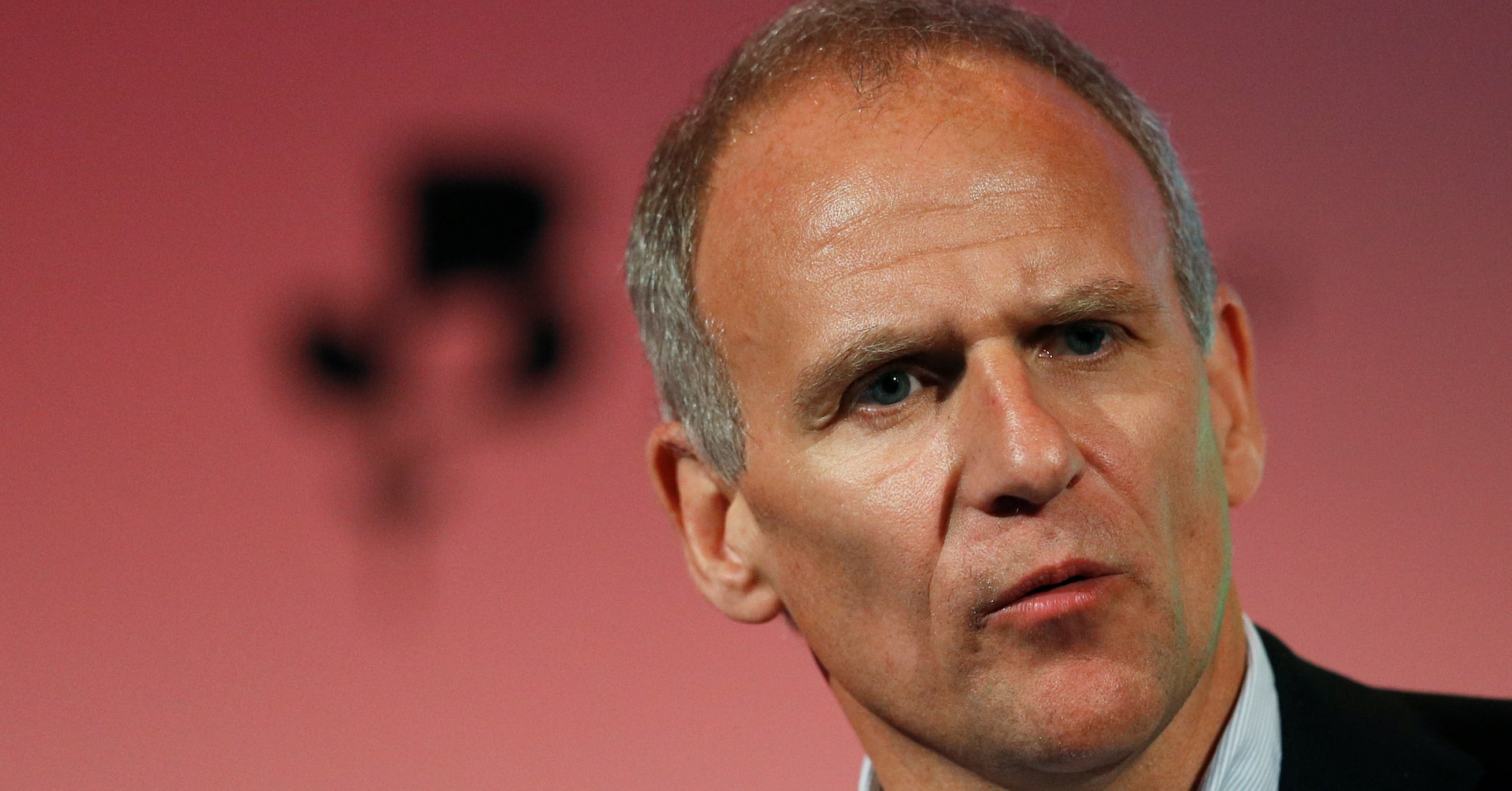

- Diageo appoints former Tesco boss Dave Lewis as new CEO

- Lewis known as "Drastic Dave" for his cost-cutting turnarounds

- Diageo faces high debt, negative credit outlook, and slowing demand

In a move to revive growth during a challenging period, Diageo, the world's largest spirits maker, has appointed former Tesco boss Dave Lewis as its new CEO. Lewis, known in financial circles as "Drastic Dave" for his sweeping turnaround of businesses, will now put his reputation as a cost-cutter to the test.

As of June, Diageo's net debt stood at around 3.4 times EBITDA, and in September, Fitch Ratings changed the company's credit rating outlook to "negative," hinting at a possible downgrade. Investors and analysts expect Lewis to prioritize cost reductions and asset disposals to shore up Diageo's balance sheet. However, the current industry landscape, with U.S. tariffs on alcohol imports and younger consumers retreating from alcohol purchases, may not be the most favorable time for asset sales.

Nevertheless, Lewis will likely need to consider selling regional businesses, such as East African Breweries, Diageo's Chinese baijiu business, the Ypióca cachaça brand in Brazil, and its Turkish raki operations, in order to deleverage the company. A sale of the iconic Guinness brand or Diageo's stake in Moët Hennessy, however, is considered unlikely.

As Diageo navigates this challenging period, investors will be closely watching to see how Lewis shapes the $53 billion company and whether he will be tempted to cut shareholder dividends to give the business more financial flexibility.