Home / Business and Economy / Tepper Pivots: Dumps Intel/Oracle for AI Stars

Tepper Pivots: Dumps Intel/Oracle for AI Stars

4 Dec, 2025

Summary

- David Tepper's Appaloosa exits Intel and Oracle in Q3.

- Fund manager increases stake in Nvidia and bets on AMD.

- Investor likely capitalizing on AI bubble fears and contrarian strategy.

David Tepper's renowned hedge fund, Appaloosa Management, has made significant portfolio adjustments in the third quarter, exiting positions in established tech companies Intel and Oracle. While the specific motivations remain undisclosed, Tepper's established strategy of investing in distressed assets and value equities, often during periods of market stress, provides insight into these decisions. His reputation as a "master of contrarian investing" was solidified by his successful trades during the 2008 financial crisis.

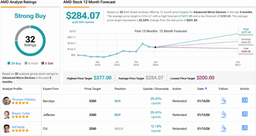

The fund's recent filings with the SEC reveal a notable pivot towards the artificial intelligence sector. Appaloosa has substantially boosted its investment in Nvidia, a leading GPU manufacturer crucial for AI development, and has also taken a new position in Advanced Micro Devices, another significant player in AI infrastructure. This strategic reallocation indicates a strong conviction in the future growth potential of AI.

Tepper's shift away from Intel, which faces challenges in its foundry turnaround and has lost market share to AMD, and potentially booking profits on Oracle after its strong run, aligns with his focus on companies with clear growth catalysts. The move into AI infrastructure, despite potential bubble fears, underscores Tepper's willingness to embrace perceived risks for outsized returns.