Home / Business and Economy / Credit Scares Signal Danger Zone for Stocks?

Credit Scares Signal Danger Zone for Stocks?

10 Dec, 2025

Summary

- JP Morgan CEO Jamie Dimon compares recent credit scares to 'cockroaches'.

- Investors fear a credit cycle where borrowers are squeezed and lenders pickier.

- Unlike 2008, current risks lie with private lenders and shadow credit.

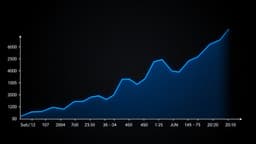

Recent credit scares are prompting concern among investors about the stock market's outlook. While the Federal Reserve continues to cut rates, a potential credit cycle is emerging, characterized by tighter lending standards and increased borrower pressure. This phase, distinct from the 2008 global financial crisis, sees risks migrating from traditional banking and housing to private credit markets and sectors such as media and cable. Investors are vigilant as 2026 unfolds.

The dynamics of this emerging credit cycle differ significantly from past events. Instead of focusing on bank loans and housing, the current vulnerabilities are concentrated in private lenders and shadow credit. This shift means that sectors like growth, media, and cable companies may face heightened scrutiny. Notably, private credit markets are already exhibiting higher default rates compared to traditional high-yield bonds, signaling a changing landscape for corporate debt.

While current credit stress indicators are muted compared to past crises like the early pandemic, several watch points remain. These include monitoring high-yield bond performance against Treasuries, the health of regional bank stocks, and headlines concerning media and cable debt. Additionally, the ability of weaker companies to refinance debt and consumer credit trends on Main Street will provide further signals about the overall economic environment.