Home / Business and Economy / Costco Stock Wobbles: Can It Beat the Big Box Blues?

Costco Stock Wobbles: Can It Beat the Big Box Blues?

26 Nov, 2025

Summary

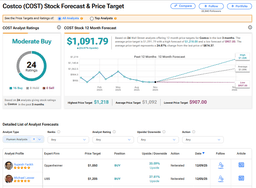

- Costco's stock has declined 10% in three months.

- The company's earnings are scheduled for December 11.

- Strong customer loyalty and brand appeal are key strengths.

Following a strong earnings report from Walmart, investors are now keenly observing Costco Wholesale Club for signs of a potential stock recovery. Costco's shares have experienced a 10% decline in the past three months, nullifying its year-to-date gains and approaching significant technical support levels. Investors are awaiting the company's official earnings announcement scheduled for December 11, while monthly sales reports may offer early indications of the stock's trajectory.

Despite the recent downward trend in its stock price, Costco possesses considerable strengths that foster investor optimism. The company is renowned for its exceptional brand loyalty, largely driven by its high-quality Kirkland Signature private label and a strong commitment to employee well-being. This customer devotion, coupled with iconic offerings like the $1.50 hot dog and soda combo, creates a robust foundation for the business.