Home / Business and Economy / Costco Stock Hits 52-Week Low Amid Consumer Worries

Costco Stock Hits 52-Week Low Amid Consumer Worries

12 Dec

Summary

- Costco's stock dropped to a new 52-week low of $871.09.

- E-commerce sales surged 20.5% year-over-year in November.

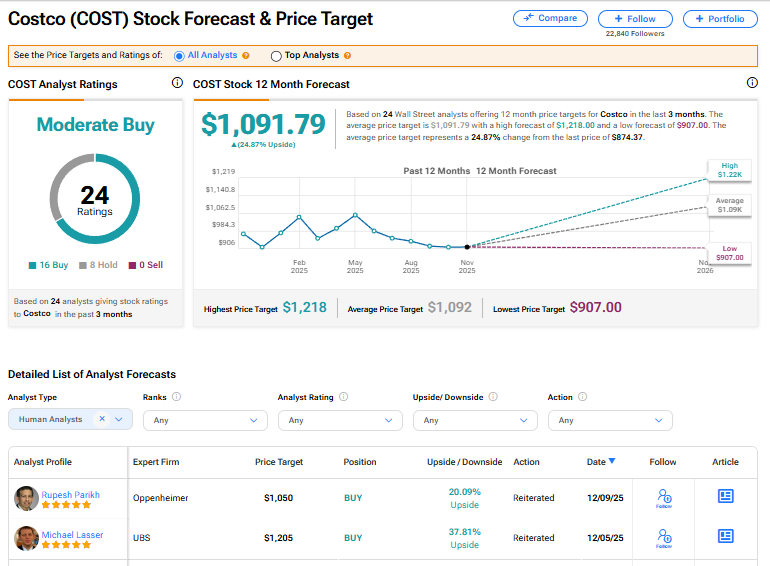

- Analysts maintain a 'Moderate Buy' rating with a price target implying upside.

Costco Wholesale's stock reached a 52-week low of $871.09 just before its fiscal first-quarter earnings report. This decline reflects widespread investor apprehension regarding the retail industry and consumer spending patterns, heightened by recent disappointing results from other retailers. Concerns also extend to potential tariff impacts on Costco's globally sourced products.

However, these fears may be overstated. Costco's own monthly sales reports indicate resilience, with November sales up 8% year-over-year. The company's e-commerce channel demonstrated remarkable strength, posting a 20.5% increase in sales. Foot traffic also saw a modest rise of 3.8%, alongside a 3% increase in average transaction value.

Wall Street analysts largely remain optimistic, with a consensus 'Moderate Buy' rating. Out of 24 analysts, 16 recommend buying and eight suggest holding. The average price target of $1,091.79 suggests a potential upside of nearly 25%, indicating confidence in Costco's ability to navigate current economic challenges.