Home / Business and Economy / Chevron Earnings Dip Ahead: Will Stock Recover?

Chevron Earnings Dip Ahead: Will Stock Recover?

3 Jan

Summary

- Chevron's Q4 2025 adjusted EPS expected to drop 25.2% year-over-year.

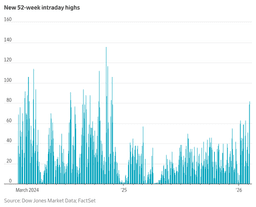

- Stock gained 6.5% in 52 weeks, lagging the S&P 500's 16.4% rise.

- Analysts maintain a 'Moderate Buy' with a $169.59 average price target.

Chevron Corporation (CVX), a major global energy and chemicals company, is preparing to announce its fiscal Q4 2025 financial results. Analysts anticipate a significant 25.2% decrease in adjusted earnings per share (EPS) compared to the same period last year. While Chevron has a history of exceeding earnings expectations, this quarter is projected to show a decline.

Despite a recent 2.7% stock increase on October 31st, following strong Q3 results driven by record upstream production and robust downstream profits, Chevron's stock performance over the past 52 weeks has lagged behind the S&P 500. The company's market capitalization stands at $306.9 billion.

Currently, analysts hold a cautiously optimistic outlook, with a consensus 'Moderate Buy' rating. The average price target suggests a potential upside of 11.3%, indicating that while challenges exist, there is still investor confidence in Chevron's future prospects.