Home / Business and Economy / AI Boom Fuels Long-Term Optimism for BP Despite Short-Term Uncertainty

AI Boom Fuels Long-Term Optimism for BP Despite Short-Term Uncertainty

18 Oct

Summary

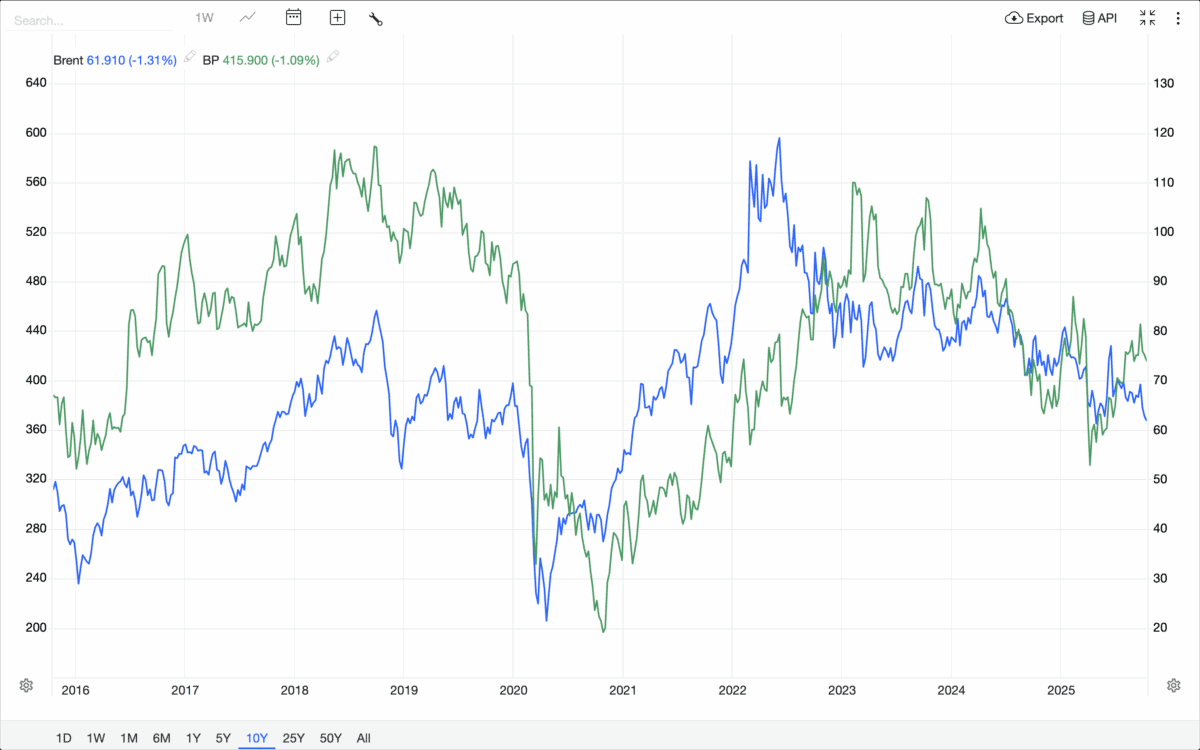

- BP shares up nearly 100% in 5 years

- Oil prices at low levels since COVID-19 pandemic

- AI infrastructure growth driving long-term energy demand

As of October 19th, 2025, BP (LSE:BP) shares have seen a remarkable rise of almost 100% over the last 5 years. However, the current state of the oil market presents both challenges and opportunities for the FTSE 100 company.

Oil prices have been trading at some of their lowest levels since the COVID-19 pandemic, with Brent crude hovering near the lower end of its 5-year range. This has been driven by factors such as increased supply from Saudi Arabia and other producers, as well as moderate demand due to uncertainty in international trade.

While the short-term outlook for oil prices remains murky, there are reasons to be optimistic about BP's long-term prospects. The rapid growth of artificial intelligence (AI) infrastructure has accounted for nearly 100% of GDP growth in the US this year, and this trend shows no signs of slowing down. Whether powered by renewables or hydrocarbons, these data centers consume vast amounts of energy, providing a significant tailwind for the energy sector.

Advertisement

Despite the current headwinds, BP's stock has historically performed well during periods of low oil prices, making the present situation an intriguing opportunity for long-term investors. The company's ability to weather short-term volatility and capitalize on the long-term energy demand driven by the AI boom could lead to further gains in the years ahead.