Home / Business and Economy / Energy Trust Fuels AI Boom with Diverse Holdings

Energy Trust Fuels AI Boom with Diverse Holdings

22 Feb

Summary

- Trust targets growing annual income with advance dividend goals.

- Invests in conventional energy, mining, and clean energy sectors.

- AI boom and data centers are driving demand for electricity.

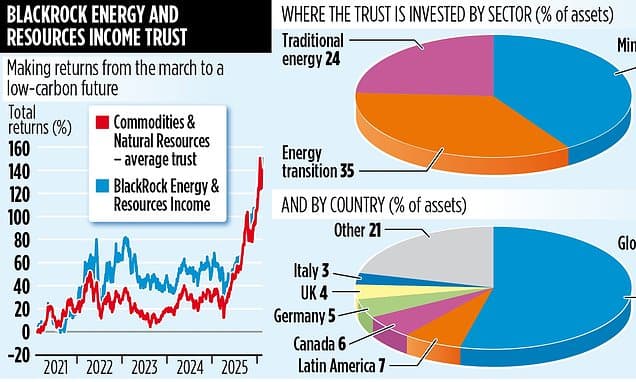

The BlackRock Energy and Resources Income Trust, managed by Tom Holl and Mark Hume, offers a compelling investment case with better five-year performance numbers than its larger counterpart, BlackRock World Mining. The trust is committed to providing shareholders with a growing annual income, with a current payment target of 1.25p per share for the financial quarter, aiming to exceed last year's 4.75p.

The trust's flexible investment approach spans conventional energy companies such as Shell and Chevron, mining operations, and businesses involved in the clean energy transition. Approximately 40% is allocated to mining, 35% to clean energy, and just under a quarter to conventional energy. A key theme exciting Holl is the demand for electricity fueled by AI and data centers, transforming grid companies and electricity generation businesses.

Key holdings include SSE for energy provision and Elia Group for grid operations in Belgium and Germany. Mining investments like Glencore and Anglo American are also significant, benefiting from the energy transition's demand for metals used in solar panels. The trust generates income from company dividends, corporate bonds, and options trading, with shares trading at a slight discount to underlying assets, which the board addresses through share buybacks.