Home / Business and Economy / Asia's Penny Stocks: Growth Gems Under $1?

Asia's Penny Stocks: Growth Gems Under $1?

16 Dec

Summary

- Asian penny stocks offer growth potential at lower price points.

- CNMC Goldmine Holdings shows strong earnings growth of 210.3%.

- CNMC Goldmine Holdings has a healthy financial position with more cash than debt.

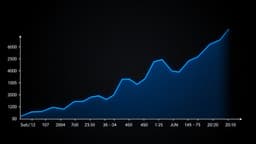

Global markets are currently reacting to the Federal Reserve's recent interest rate cuts, which have brought concerns about technology stock valuations and AI infrastructure spending to the forefront, impacting major indices. In this environment, penny stocks in Asia are surfacing as a noteworthy area for investors interested in uncovering growth potential within smaller capitalization companies.

CNMC Goldmine Holdings Limited, a Malaysian investment holding company focused on gold exploration and mining, is highlighted as a promising example. With a market capitalization of SGD445.82 million, the company has demonstrated exceptional financial performance. Its earnings have surged by 210.3% in the past year, significantly outperforming industry averages and its own historical five-year growth.

Further strengthening its appeal, CNMC Goldmine Holdings exhibits robust financial health, underscored by a high return on equity of 37.8% and improving profit margins. The company maintains healthy liquidity, possessing more cash than debt, and its short-term assets comfortably exceed its liabilities. Despite recent share price fluctuations, it trades at a notable discount to its estimated fair value, presenting an intriguing prospect for value-conscious investors.