Home / Business and Economy / American Express Thrives as Experiential Economy Struggles

American Express Thrives as Experiential Economy Struggles

17 Nov

Summary

- Cramer sees American Express as a "contraindicator" to the slumping experiential economy

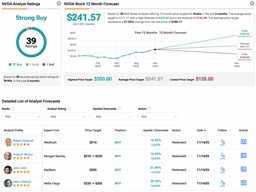

- American Express stock has reached an all-time high

- Cramer believes the company's strength warrants a price target boost

According to a recent analysis by financial commentator Jim Cramer, American Express Company (NYSE:AXP) has emerged as a bright spot in the midst of a broader slump in the "experiential economy." Cramer noted that over the past few weeks, the experiential economy, which encompasses travel and leisure-related industries, has shown signs of weakening. However, he pointed to the "continuous strength" of American Express as a counterpoint to this trend.

Cramer highlighted that American Express, known for its credit and charge cards, payment processing, banking, and travel-related services, has been performing exceptionally well. In fact, the company's stock has reached an all-time high, a testament to its resilience in the current market environment. Cramer commented that the stock's strong performance makes it a prime candidate for a price target boost, as the company continues to defy the broader challenges facing the experiential economy.

While Cramer acknowledged that he is not yet ready to completely give up on the experiential economy theme, he sees American Express as a "contraindicator" that suggests there may be pockets of strength within the sector. The company's ability to maintain its momentum in the face of broader industry headwinds underscores its unique positioning and the strength of its business model.